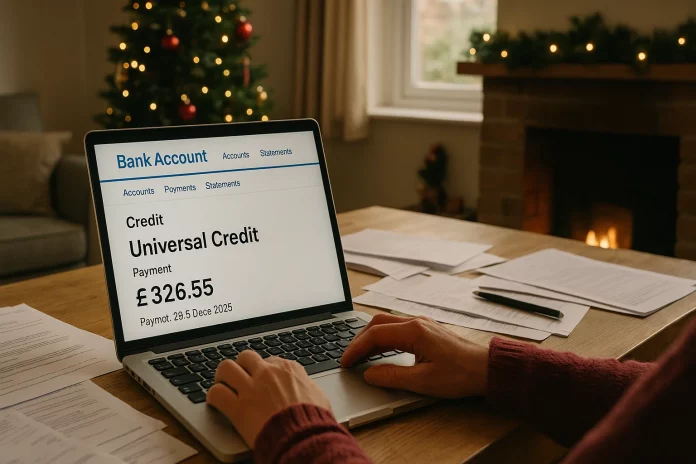

With Christmas approaching and living costs still high, understanding when benefits like Universal Credit will be paid is more important than ever. The festive season brings schedule changes that could affect your finances.

For those relying on DWP support, early payments are crucial for planning household budgets.

This guide outlines the revised payment dates for December 2025 and provides an overview of the financial assistance available during this critical time for millions across the UK.

What Financial Challenges Are UK Households Facing This December?

As December progresses, many UK households face growing financial pressure. Despite inflation returning to more stable levels, the high cost of essentials continues to affect low and middle-income families.

Daily living costs have not significantly decreased, and rising energy prices, rent, and grocery bills continue to strain household budgets.

Recent figures from the Trussell Trust reveal that 14 million adults are going without meals due to lack of affordability.

Energy arrears have doubled in five years, reaching £4.4 billion by June 2025. The Joseph Rowntree Foundation projects that by the next general election in 2029, UK families will experience the worst drop in living standards on record.

Policy in Practice estimates that £24 billion worth of benefits go unclaimed each year. This unclaimed financial support could significantly ease the burden for many.

There are currently around 24 million people receiving some form of DWP-administered support, including pensions and working-age benefits.

What Are the Key December 2025 Benefit Payment Dates?

December typically includes a number of public holidays that affect regular payment schedules. Benefits like Universal Credit, State Pension, and others are usually paid on the same day each month or every four weeks.

However, when the scheduled payment date falls on a bank holiday, the DWP processes the payment earlier.

Here are the adjusted payment dates for December 2025 and early January 2026:

| Scheduled Payment Date | Actual Payment Date |

| Thursday 25 December | Wednesday 24 December |

| Friday 26 December | Wednesday 24 December |

| Thursday 1 January | Wednesday 31 December |

The affected benefits include:

- Universal Credit

- State Pension

- Pension Credit

- Personal Independence Payment (PIP)

- Employment and Support Allowance (ESA)

- Jobseeker’s Allowance (JSA)

- Disability Living Allowance (DLA)

- Carer’s Allowance

- Child Benefit

- Attendance Allowance

- Income Support

Recipients should plan accordingly, as the next payment after an early one will still follow the original schedule, potentially creating a longer gap between payments.

When Will Pensions Be Paid Over the 2025 Holidays?

State Pension payments also follow a regular four-week cycle. The payment day is linked to the final two digits of the claimant’s National Insurance (NI) number. This structure ensures a predictable payment schedule for pensioners throughout the year.

| NI Number Ending | Payment Day |

| 00 to 19 | Monday |

| 20 to 39 | Tuesday |

| 40 to 59 | Wednesday |

| 60 to 79 | Thursday |

| 80 to 99 | Friday |

If your payment day falls on a public holiday, such as Christmas or New Year’s Day, it will be moved forward to the last working day beforehand.

Pensioners are encouraged to check their bank statements ahead of the holidays and ensure they have funds to cover essential spending.

Will Universal Credit and Other Benefits Increase in 2026?

From April 2026, claimants of Universal Credit and other benefits will receive increased payments. The standard allowance is being raised by 6.2% to help offset living costs. These increases apply to both individuals and couples.

| Claimant Type | Current Weekly Amount | April 2026 Amount | Weekly Increase |

| Single person over 25 | £92 | £98 | +£6 |

| Couple with one or both over 25 | £145 | £154 | +£9 |

In addition to Universal Credit, benefits such as PIP, DLA, Attendance Allowance, Carer’s Allowance and ESA will increase by 3.8%, reflecting September’s inflation figures.

A significant change is also coming to the health-related component of Universal Credit. From April 2026, the monthly rate for new claimants will drop from £105 to £50. For existing claimants, the rate will remain frozen until 2029.

This results in a loss of more than £200 per month for new recipients, making it vital for those with eligibility concerns to apply as soon as possible.

The State Pension will also rise by 4.8% in April 2026, taking the weekly amount to £241.05. This increase aligns with annual wage growth and supports retirees during a time of high living costs.

What Government Support Schemes Are Available This Winter?

Households experiencing financial hardship can access several support programmes offered by the government and local authorities.

Budgeting Advance Loans

Those receiving Universal Credit may qualify for a Budgeting Advance. This interest-free loan is intended for emergency or essential expenses and is deducted from future Universal Credit payments.

Maximum amounts available:

- £348 for single individuals

- £464 for couples

- £812 for claimants with children

As of April 2025, repayments are capped at 15% of the Universal Credit standard allowance, down from the previous 25%, allowing claimants to retain more of their monthly income.

Discretionary Housing Payment (DHP)

If you receive Housing Benefit or the housing component of Universal Credit and are struggling with rent, you can apply for a Discretionary Housing Payment through your local council. This support may cover:

- Rent shortfalls

- Rent deposits

- Advance rent if relocating

Eligibility and available funds differ by council, so it’s essential to contact your local authority for specific criteria.

Household Support Fund (HSF)

The HSF is a government-backed initiative delivered by local councils to provide additional help to households in need. Support may come in various forms:

- Financial contributions towards utility bills

- Replacement of essential household appliances

- Emergency cash payments (up to £300 in some cases)

The fund will continue to run until March 2026, after which it is set to become the Crisis and Resilience Fund with a national funding commitment of £1 billion.

Can You Get Charitable Grants and Energy Support?

In addition to government support, several charities provide grants to those facing financial hardship. Eligibility varies depending on personal circumstances. These grants are typically targeted toward specific groups such as:

- Disabled individuals

- Carers

- Bereaved families

- Low-income households

- Students

The charity Turn2us offers a grant search tool to help identify potential sources of support.

Energy providers also operate schemes to assist customers who are struggling to pay their bills. Major suppliers like British Gas, EDF, E.ON, Scottish Power and Octopus provide:

- Payment support plans

- Free energy-saving devices (e.g. electric blankets)

- Grants to cover arrears in extreme circumstances

It’s advisable to contact your provider directly to explore available options.

Are You Eligible for Social Tariffs on Broadband and Water?

Social tariffs are reduced-rate services designed for those on low incomes or in receipt of certain benefits. These are available for both broadband and water services.

Water Social Tariffs

Every UK water supplier is required to offer a social tariff. However, the level of support can vary significantly between providers.

Examples of variation:

- Some providers offer up to 90% off bills

- Others limit discounts to 20%

Because you cannot choose your water supplier, support often depends on your location. This postcode-based variation has led to criticism regarding fairness.

Broadband Social Tariffs

Several broadband providers offer social tariffs for those claiming Universal Credit, Pension Credit or other qualifying benefits. Ofcom maintains a guide detailing available offers, which can help households access affordable internet connectivity essential for work, school and benefit applications.

How Can You Reduce Your Council Tax Bill?

Many households may be eligible for a Council Tax Reduction based on their income, benefits received, or overall financial situation.

Support may include:

- Reductions of up to 100% for those on qualifying benefits

- Discretionary discounts for households facing severe hardship

Each local council manages its own scheme, and eligibility requirements can differ. Applications should be made directly through your local authority’s website.

Is Free Childcare Expanding in 2025?

From September 2025, working parents of children under the age of four will be entitled to up to 30 hours of free childcare per week. This marks the final phase of a planned expansion which began in 2024.

To access the scheme:

- Parents must apply online through the government’s childcare portal

- Eligibility must be reconfirmed every three months

- Tax-Free Childcare may also apply, allowing parents to save up to £500 annually

This expansion is intended to support working families and increase employment opportunities for parents.

Is the Energy Price Cap Changing in Early 2026?

Ofgem’s energy price cap will see a minor change at the start of 2026. The cap for October to December 2025 was set at £1,755, which will rise slightly to £1,758 for January to March 2026.

The cap represents the maximum annual cost for an average household on a standard variable tariff, but actual bills will vary based on energy usage.

Despite the modest increase, many energy experts and Ofgem recommend comparing fixed-rate tariffs. Some fixed deals available on the market currently fall below the price cap, offering potential savings for consumers.

Will There Be Another Cost of Living Payment in 2025?

As of December 2025, the Department for Work and Pensions has not announced any plans to continue the Cost of Living Payment scheme into 2026. The final round of payments under the scheme was distributed between 6 and 22 February 2024.

Claimants are advised to monitor official DWP announcements and check their eligibility for ongoing benefits and local council support in the meantime.

Where Can You Find Mental Health Support During Financial Stress?

Financial difficulties can have a significant impact on mental health. There are several organisations offering support across the UK:

- Samaritans: Available 24/7 by calling 116 123 or via email at jo@samaritans.org

- Mind: Offers emotional support and guidance on welfare benefits

- Scope: Provides community forums and advice for disabled individuals

- NHS: Operates an online mental health triage and crisis support service

Accessing these services can help individuals manage emotional stress during financially challenging periods.

Conclusion

As December 2025 unfolds, knowing your Universal Credit and benefit payment dates can make a real difference.

With early disbursements scheduled around the bank holidays, recipients should prepare in advance. Beyond this, various government schemes and local support are available to help households navigate the winter months.

From increased benefit rates in 2026 to emergency funding options, it’s essential to claim what you’re entitled to and stay informed about the help available this festive season.

FAQs About Universal Credit and Holiday Payments

Will Universal Credit be paid early in December 2025?

Yes, if your regular payment falls on a bank holiday, such as 25 or 26 December, you will receive your Universal Credit early typically on 24 December.

Are DWP offices closed over Christmas?

DWP offices are closed on bank holidays. However, automated payments are scheduled in advance to ensure recipients receive their benefits on time.

Can I still apply for Universal Credit over Christmas?

Yes, you can apply for Universal Credit online 24/7, even during the holiday period. However, processing may take longer due to closures.

Will tax credits also be paid early in December 2025?

Yes, tax credits follow similar rules. Payments due on 25 or 26 December will be paid on 24 December instead.

What happens if my benefit payment is late?

If your benefit payment doesn’t arrive on the expected date, contact your bank first. If the issue persists, contact the DWP once offices reopen.

How do I find my council’s Household Support Fund details?

Visit your local council’s official website or search “Household Support Fund [Your Council Name]” for specific eligibility criteria and application forms.

How can I calculate which benefits I’m entitled to?

Use Policy in Practice’s benefit calculator or visit gov.uk’s benefits section to check your eligibility.