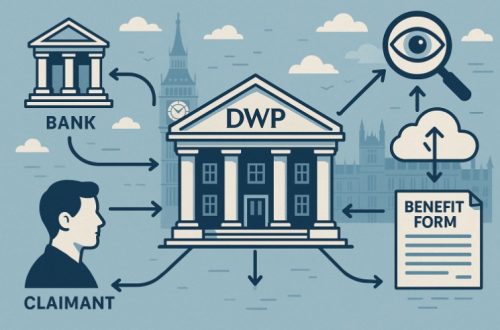

When claiming benefits in the UK, many people wonder how closely the Department for Work and Pensions (DWP) monitors their bank accounts.

The issue raises questions about privacy, compliance, and the consequences of not keeping personal finances transparent.

This blog will answer these concerns and explore how often the DWP checks bank accounts, why these checks occur, and what claimants need to know to stay within the rules.

What is the Role of the DWP in Monitoring Bank Accounts?

The Department for Work and Pensions (DWP) is responsible for administering a wide range of social security benefits in the UK.

To ensure that these benefits are issued fairly and correctly, the DWP is empowered to conduct financial checks on claimants.

This monitoring is not constant or invasive in every case. Rather, it’s a compliance process to detect fraudulent or incorrect claims and ensure the benefit system works as intended.

The department operates within a legal framework that allows it to access and verify financial details under specific conditions.

DWP oversight applies to various benefits such as:

- Universal Credit

- Pension Credit

- Housing Benefit

- Employment and Support Allowance (ESA)

- Income Support

Each of these benefits has different rules regarding income and savings thresholds, which influences how closely bank accounts are monitored.

Why Does the DWP Check Claimants’ Bank Accounts?

The Department for Work and Pensions (DWP) checks claimants’ bank accounts to maintain the integrity of the UK benefits system. These checks are not conducted without reason—they serve a range of essential functions that are critical to ensuring that public funds are correctly distributed, misuse is minimised, and the system remains fair and sustainable.

The bank account checks typically fall under three main purposes: detecting fraud, preventing and recovering overpayments, and maintaining compliance with eligibility rules. Each of these purposes supports the broader aim of ensuring financial accountability across the welfare system.

1. To Detect and Prevent Benefit Fraud

One of the DWP’s key responsibilities is to identify and prevent fraudulent claims. Benefit fraud occurs when someone deliberately provides false or misleading information, or fails to report a change in circumstances to continue receiving payments they are no longer entitled to. Common forms of benefit fraud include:

- Not declaring income from employment or self-employment

- Failing to report savings or capital exceeding the allowed thresholds

- Living with a partner while claiming benefits as a single person

- Using false documents or identities to make a claim

By checking bank accounts, the DWP can uncover discrepancies between what a claimant has reported and their actual financial situation. For example, large deposits, unexplained income, or regular payments from third parties might suggest undeclared work or other sources of income that should be factored into a benefit calculation.

These checks are often targeted, triggered by data-matching results, whistle-blower reports, or internal suspicions during a review process.

2. To Identify Overpayments and Recover Public Funds

Even when fraud isn’t involved, overpayments are a common issue in the benefits system. These can happen due to:

- Delays in claimants reporting changes (e.g., new job, partner moving in)

- Administrative errors during benefit calculations

- Misunderstandings around benefit entitlement criteria

For example, if a claimant’s savings increase above the permitted threshold and they fail to notify the DWP, they may continue to receive payments they’re not eligible for. In such cases, the DWP has a duty to recover the overpaid amounts.

Bank account reviews help the DWP detect such situations. Once an overpayment is identified, the department will usually contact the claimant with a breakdown of the overpaid amount and outline repayment options, which may include deductions from future benefit payments.

3. To Ensure Ongoing Compliance with Eligibility Criteria

Most benefits come with specific financial eligibility criteria, particularly concerning income, savings, and capital. For example:

- Universal Credit is means-tested, and income from employment, savings, or capital can directly impact the payment amount.

- Pension Credit is also affected by savings, with the first £10,000 ignored, and a notional income applied for amounts above this.

- Housing Benefit and Income Support also have savings thresholds that affect eligibility or reduce benefit amounts.

To stay compliant, claimants are expected to keep the DWP updated with any change in circumstances. However, the reality is that not everyone reports changes promptly—sometimes due to oversight, other times due to fear of losing support.

Bank account checks help the DWP verify whether a claimant’s current financial situation still qualifies them for the benefits they receive. These checks may be part of a routine reassessment or triggered by a specific concern.

4. To Protect Public Confidence in the Benefits System

The UK benefits system is funded by taxpayers. To maintain public trust, the government must demonstrate that this system is being properly managed. Unchecked fraud or persistent errors would undermine confidence in welfare support, potentially fuelling negative public perception and influencing policy decisions.

By proactively checking financial records, the DWP shows that it takes fraud prevention seriously and is committed to ensuring only those who genuinely qualify for support are receiving it.

Summary of Key Reasons:

| Purpose | Description |

| Detect Fraud | Identify false claims and undeclared income or capital |

| Prevent Overpayments | Ensure accurate benefit payments based on up-to-date financial information |

| Maintain Eligibility | Confirm claimants still meet savings and income requirements |

| Protect Public Confidence | Reassure taxpayers that the system is fair and properly managed |

By regularly reviewing bank accounts and financial data, the DWP reinforces its role not only as a distributor of welfare but also as a regulator of financial compliance within the benefits system. These checks are an essential tool for keeping the system transparent, fair, and resilient against abuse.

How Often Are DWP Bank Account Checks Carried Out?

There is no universally set schedule for how often the DWP checks bank accounts. Frequency depends on a combination of factors including the type of benefit claimed, risk indicators, and whether there has been a history of overpayments or discrepancies.

Claimants receiving Universal Credit, for example, may undergo more frequent assessments because the benefit is adjusted monthly based on changes in income and circumstances.

In contrast, recipients of long-term benefits such as Pension Credit might be reviewed annually or only if specific triggers arise.

Some common scenarios that affect frequency include:

- Previously identified overpayments or fraud

- Data mismatches found through automated systems

- Changes reported by the claimant or detected through third-party data

In many cases, checks are carried out without informing the claimant in advance.

Frequency of DWP Bank Account Checks by Benefit Type

| Benefit Type | Frequency of Checks | Typical Monitoring Interval |

| Universal Credit | High | Monthly or Quarterly |

| Pension Credit | Low to Moderate | Annual or Trigger-Based |

| Housing Benefit | Moderate to High | Quarterly or on Change Events |

| Income Support | Moderate | Semi-Annually |

| ESA | Moderate | Periodic or Trigger-Based |

What Triggers a DWP Bank Account Investigation?

Bank account investigations by the DWP are not arbitrary. They are typically triggered by events or inconsistencies flagged by internal systems or external reports.

Key triggers for an investigation include:

- A claimant reporting a change in financial circumstances

- An anonymous tip suggesting undeclared income

- A mismatch between declared income and HMRC records

- Large or suspicious transactions appearing on bank statements

- A significant increase in savings without explanation

The DWP also uses data-matching technology that automatically cross-references a claimant’s financial data with information from other government bodies, including HMRC and local councils.

When a discrepancy arises, the system flags the case for further review by a compliance officer.

How Does the DWP Access and Analyse Financial Information?

The DWP cannot freely access every citizen’s bank account. It must follow legal and procedural frameworks when requesting financial information. In most cases, access is granted under the authority of the Social Security Administration Act or through claimant consent given during benefit application.

The DWP may obtain financial information via:

- Data-matching systems that compare bank, tax, and employment data

- Direct requests to financial institutions during investigations

- Reviews initiated by reports or audit findings

Once obtained, the data is reviewed for any signs of undeclared income, savings exceeding threshold limits, or patterns of spending inconsistent with benefit entitlements.

Banks are not obligated to proactively report to the DWP, but they must comply when the DWP requests data as part of a formal investigation.

Can the DWP Check Savings and Joint Accounts?

Yes, savings and joint accounts are both subject to review. Claimants are required to declare all savings as part of their benefit application and during any reassessment.

For benefits such as Universal Credit and Pension Credit, savings can directly impact eligibility or payment amounts. Exceeding the savings limit could reduce the benefit or make the claimant ineligible.

Joint accounts are typically assumed to be shared equally between account holders unless proven otherwise. This means that 50% of the balance is usually counted toward each claimant’s financial assets.

Table: Savings Thresholds and Impact on Benefits

| Benefit Type | Lower Savings Threshold | Upper Savings Limit | Impact of Savings |

| Universal Credit | £6,000 | £16,000 | Reduced award above £6,000, ineligible above £16,000 |

| Pension Credit | £10,000 | No strict upper limit | Savings over £10,000 reduce entitlement |

| Housing Benefit | £6,000 | £16,000 | Full benefit below £6,000, tapered above |

| Income Support | £6,000 | £16,000 | Affects eligibility above threshold |

| ESA | £6,000 | £16,000 | May reduce or stop benefits |

What Happens if the DWP Finds Discrepancies?

If a discrepancy is found during a financial review, the DWP typically takes a structured approach to resolve the issue.

- Request for clarification: The DWP may contact the claimant and ask for additional documentation or explanations.

- Suspension of payments: In cases where the evidence is significant, benefit payments may be temporarily suspended while the investigation proceeds.

- Overpayment recovery: If an overpayment is confirmed, the DWP will issue a notice and start recovery procedures, often by reducing future benefit payments.

- Civil penalties or prosecution: Where there is clear evidence of intentional fraud, the DWP may impose a financial penalty or pursue criminal prosecution.

Claimants have the right to appeal decisions or challenge overpayment notices if they believe there has been a mistake.

How Can Claimants Avoid Issues During DWP Checks?

Most issues arise from a lack of understanding or failure to update the DWP about changes. To avoid complications:

- Keep a written record of all income and savings

- Report changes such as new employment, inheritance, or additional income as soon as possible

- Store bank statements, pay slips, and relevant documents for at least 12 months

- Seek help from a welfare rights adviser or legal expert if unsure about reporting duties

Staying organised and transparent is the best way to avoid penalties or suspension of benefits.

Is It Legal for DWP to Check Bank Accounts Without Permission?

Yes, under current UK legislation, the DWP has legal authority to request financial information from banks and financial institutions as part of a benefit fraud investigation. Claimants agree to certain conditions during the application process, including permission for data to be shared between agencies.

These powers are used selectively and must comply with the Data Protection Act 2018 and the General Data Protection Regulation (GDPR). The checks must be proportionate, necessary, and relevant to the claim under investigation.

What Are the Most Common Myths About DWP Bank Checks?

There are several misconceptions surrounding how the DWP conducts bank checks. Clearing these up is important for claimants to understand their rights and responsibilities.

Common myths include:

- The DWP monitors every account continuously

- All checks require prior notice

- Online banks are exempt from scrutiny

- You can hide money by placing it in someone else’s account

In reality, the DWP conducts targeted checks, and most banks, including digital-only ones, are required to cooperate with government investigations.

How Are DWP Checks Expected to Evolve in the Future?

With the increasing use of digital tools in government, DWP checks are expected to become more sophisticated. The department is investing in automated systems that improve fraud detection without increasing administrative overhead.

Future developments may include:

- Real-time data-sharing systems with HMRC and financial institutions

- Artificial intelligence to predict fraudulent behaviour

- More regular audits based on claim history

While this may raise concerns about privacy, the aim is to increase accuracy and ensure support reaches the right people.

Conclusion

Bank account checks by the DWP are a standard part of benefit compliance in the UK. While not all claimants will face scrutiny, it’s essential to understand how and why checks occur.

Transparency, prompt reporting, and record-keeping are the best ways to stay within the rules and avoid complications. With the right approach, claimants can protect themselves and continue receiving the support they need.

FAQs About How Often DWP Check Bank Accounts

Can the DWP see every transaction in my bank account?

No, they do not routinely see every transaction. However, during an investigation, they may request full bank statements.

Will I be notified before a DWP bank check?

Not always. While some checks are scheduled, others may happen without your knowledge to preserve investigation integrity.

Does the DWP monitor bank accounts in real time?

No, they do not have real-time access. They typically perform checks when triggered by events or data anomalies.

Are online bank accounts also checked by the DWP?

Yes. All UK-registered bank accounts, including online banks, can be reviewed when required.

How long does a typical DWP investigation last?

This varies depending on complexity, but most last a few weeks to a few months.

What should I do if I suspect an error in DWP findings?

You should contact the DWP immediately and submit any supporting documents to clarify the issue.

Can I refuse access to my bank information?

You may challenge a request, but refusal can affect your benefit eligibility and may raise further suspicions.