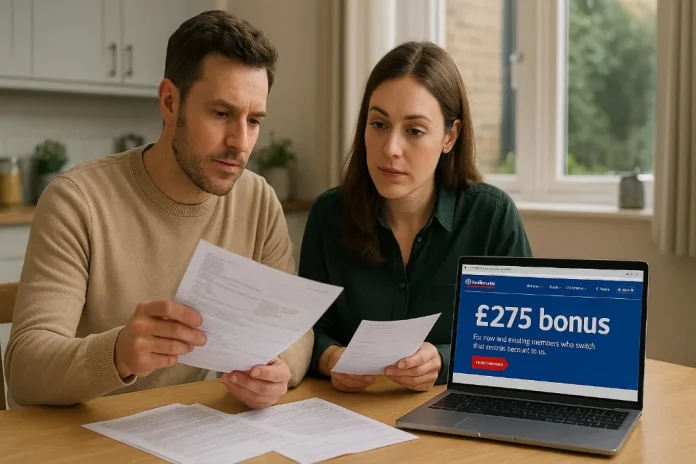

Nationwide Building Society is offering eligible customers the chance to earn up to £275 in cash through a combination of its £175 switching incentive and a £100 reward under the Fairer Share Payment scheme.

For anyone considering a bank account switch or seeking added value from their financial provider, this offer presents a significant opportunity.

This article explores how customers can qualify for the full £275 bonus, outlines the eligibility criteria, explains the switching process, and compares Nationwide’s deal with similar incentives available from other UK banks.

What Is The Nationwide Building Society Cash Bonus Offer In 2025?

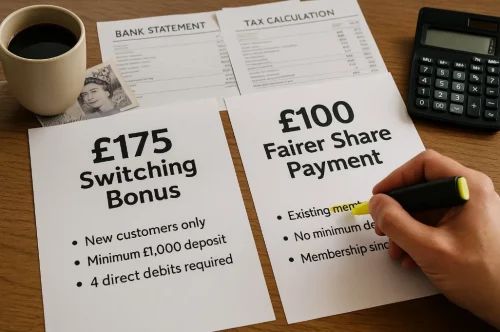

Nationwide Building Society is providing customers the opportunity to receive a combined bonus of up to £275. This includes two separate incentives:

Nationwide Building Society is providing customers the opportunity to receive a combined bonus of up to £275. This includes two separate incentives:

- £175 cash reward for switching a current account to Nationwide

- £100 reward from the Fairer Share Payment scheme for qualifying members

The switching bonus is targeted at new customers who open a FlexDirect, FlexAccount or FlexPlus current account and transfer their existing current account using the Current Account Switch Service.

The Fairer Share Payment is a reward for existing customers who meet specific membership requirements.

These bonuses are part of the building society’s broader effort to reward both new and loyal customers.

How Can Customers Claim The £175 Switching Bonus?

To receive the £175 switching bonus from Nationwide, customers must fulfil several eligibility conditions.

- Open an eligible current account: FlexDirect, FlexAccount or FlexPlus

- Use the Current Account Switch Service to move from another bank

- Switch at least two direct debits

- Complete the full switch within 28 days

- Pay in a minimum of £1,000 within 31 days of account opening or starting the switch

- Make at least one debit card purchase within that time frame

Once these requirements are met, the £175 bonus is paid directly into the new account. The payment is usually processed within 10 calendar days and appears as “Switching Offer” on the customer’s bank statement.

This offer is limited to one payment per person and cannot be repeated if a customer has previously received a switching bonus from Nationwide.

What Steps Must Be Followed To Switch To Nationwide Successfully?

Switching to Nationwide Building Society is made simple through the Current Account Switch Service (CASS).

Switching to Nationwide Building Society is made simple through the Current Account Switch Service (CASS).

This service ensures that all your payments, direct debits, and standing orders are transferred accurately and efficiently, without you needing to contact your old bank.

Choose An Eligible Nationwide Account

To begin the process, the customer must first open one of Nationwide’s eligible current accounts. The following accounts qualify for the switching offer:

- FlexDirect

- FlexAccount

- FlexPlus

Each account has different features, so customers should select one that suits their banking needs. For example, FlexDirect offers interest on balances, while FlexPlus includes insurance benefits.

Start The Switch With The Current Account Switch Service

During the application process, customers must choose to initiate the switch using the Current Account Switch Service. This option is available online or in-branch.

They’ll need to provide:

- The sort code and account number of the bank they’re switching from

- Details of any existing direct debits to be transferred

Nationwide handles all the logistics, including contacting the old bank and setting the official switch date.

Include At Least Two Active Direct Debits

One of the key requirements for the £175 switching bonus is the inclusion of a minimum of two direct debits. These must be active and successfully switched over to the new Nationwide account.

Typical qualifying direct debits may include:

- Utility bills

- Mobile phone contracts

- Subscriptions such as streaming services

Without two direct debits, customers will not meet the full eligibility criteria.

Complete The Switch Within 28 Days

The entire switch process must be fully completed within 28 days of account opening or switch initiation to qualify for the bonus.

This includes:

- Closure of the old account

- Transfer of direct debits

- Setup of the new account for regular use

CASS guarantees that payments to and from your old account will continue seamlessly.

Meet The Pay-In And Transaction Requirements

After opening the new account and completing the switch, the customer must:

- Deposit a minimum of £1,000 into the account within 31 days

- Make at least one debit card transaction within that same timeframe

This could be a simple purchase online or in-store. These final steps ensure full eligibility for the bonus.

Receive The £175 Bonus Payment

If all steps are successfully completed, the £175 switching bonus will be deposited into the account. Nationwide processes the payment within 10 calendar days after confirming all requirements have been met.

It will appear clearly on your statement labelled as “Switching Offer”.

Who Is Eligible For The £100 Fairer Share Payment?

The £100 Fairer Share Payment is a reward given to qualifying Nationwide members as part of the building society’s profit-sharing initiative.

It is separate from the switching bonus and is intended to reward long-term customers who maintain multiple financial relationships with Nationwide.

To qualify, customers must:

- Have a current account with Nationwide, and

- Also hold either a savings account or a Nationwide mortgage

Eligibility may vary depending on the building society’s annual financial performance. The Fairer Share Payment is not a guaranteed annual benefit. It is subject to Nationwide’s discretion and availability of surplus profits to share with members.

The most recent round of Fairer Share Payments saw more than four million customers receive £100 each. According to Nationwide, some customers have received a cumulative £300 since 2023 from this scheme alone.

What Is The Bonus Eligibility Criteria For Joint Accounts?

In the case of joint current accounts, the following rules apply:

- Only one £175 switching bonus is paid per account, even if it is held jointly

- Only one Fairer Share Payment will be made per qualifying member account

Customers cannot receive multiple bonuses under the same switching process. For couples or partners opening a joint account, it is advisable to designate one person to be the main account holder if only one is eligible.

The switching bonus is tied to the account, not each individual account holder. For those wanting to maximise potential rewards, individual current accounts may be a better route depending on their eligibility.

How Does Nationwide’s Bonus Compare With Other UK Banks?

Nationwide’s combined offer of up to £275 stands out in a competitive banking landscape where several banks are offering incentives to encourage current account switching.

Nationwide’s combined offer of up to £275 stands out in a competitive banking landscape where several banks are offering incentives to encourage current account switching.

Here is a comparison of current bank switching bonuses:

| Bank | Switching Bonus |

| Lloyds Bank | £200 |

| TSB | £180 |

| NatWest | £175 |

| Royal Bank of Scotland | £175 |

| First Direct | £175 |

| Santander | £175 |

| Nationwide | £275 (Combined) |

While the initial £175 switching bonus matches offers from several other providers, the extra £100 Fairer Share Payment sets Nationwide apart. It provides more value for eligible members who meet the account and savings or mortgage conditions.

This makes Nationwide’s offer the most rewarding current deal in the UK banking sector for customers who can qualify for both payments.

How Can Customers Check Their Eligibility For The Bonuses?

To ensure they qualify for the switching bonus or the Fairer Share Payment, customers should review the full eligibility criteria provided by Nationwide.

Key actions to confirm eligibility:

- Visit the Nationwide Building Society website

- Review the specific terms and conditions for the switching offer

- Use any eligibility checker or online guide provided

- Confirm the qualifying account types: FlexDirect, FlexAccount or FlexPlus

- Ensure you haven’t previously claimed a Nationwide switching bonus

- Check if you hold a Nationwide mortgage or savings account for the Fairer Share Payment

Nationwide’s website provides detailed breakdowns of requirements and contact options for customer support if further clarification is needed.

Is The Nationwide Cash Bonus Recurring Or One-Time?

The £175 switching bonus is a one-time reward that is limited to new customers who complete a full switch and meet all the listed requirements.

Once claimed, customers are not eligible to receive another switching bonus from Nationwide in the future.

The £100 Fairer Share Payment is not guaranteed each year. It is awarded based on the building society’s annual performance and customer qualification status.

While some members have received the payment more than once, it is not a permanent benefit and is subject to change.

Nationwide regularly reviews its reward structure and announces eligible recipients for the Fairer Share Payment via direct communication and official channels.

What Are The Key Differences Between The Two Nationwide Bonuses?

To help customers understand the structure of the combined £275 bonus, here is a table comparing the two incentives:

To help customers understand the structure of the combined £275 bonus, here is a table comparing the two incentives:

| Criteria | £175 Switching Bonus | £100 Fairer Share Payment |

| Customer Type | New only | Existing qualifying members |

| Required Account Type | FlexDirect, FlexAccount, FlexPlus | Any current account + savings or mortgage |

| Direct Debits Required | Yes (Minimum two) | No |

| Minimum Deposit | £1,000 within 31 days | Not required |

| Debit Card Usage | At least one transaction | Not required |

| Switching Service Needed | Yes | No |

| Account Closure Needed | Yes (old account closes) | No |

| Payment Timeline | Within 10 days post-switch | Varies (announced by Nationwide) |

| Frequency | One-time only | Recurring (not guaranteed yearly) |

Understanding these distinctions helps customers plan accordingly to maximise their rewards with Nationwide. Those eligible for both can take advantage of the full £275 offer by ensuring all criteria are met.

What Should Customers Know Before Initiating A Switch?

Although the switching process is straightforward, customers should prepare carefully to avoid disruptions and ensure the transition is smooth.

Although the switching process is straightforward, customers should prepare carefully to avoid disruptions and ensure the transition is smooth.

Your Old Account Will Be Closed

By using the Current Account Switch Service, customers are agreeing to close their old current account. This is a key part of the process and cannot be bypassed.

It’s important to ensure there are no pending transactions or unresolved issues with the old account before initiating the switch.

Monitor All Scheduled Payments

Before switching, customers should make a list of all existing:

- Direct debits

- Standing orders

- Recurring card payments

Although CASS moves over direct debits and standing orders, some card-based subscriptions (such as Netflix or Amazon Prime) may not transfer automatically and must be updated manually.

Notify Employers And Income Sources

Customers should ensure that any income being deposited into their old account is redirected to the new Nationwide account. This may include:

- Employer payroll departments

- HMRC tax rebates

- Benefit payments or pensions

Although CASS redirects payments for 36 months, updating details with the source is strongly recommended.

Consider Overdrafts Or Linked Services

If the old account had an authorised overdraft, customers should check whether they need one on the new Nationwide account. Nationwide offers overdrafts, but approval is subject to credit checks.

Also, check for any services linked to the old account, such as:

- Credit cards

- Joint accounts

- Account-linked savings or insurance

These services may need to be managed separately.

No Impact On Your Credit Score

Using the Current Account Switch Service does not affect your credit score. However, banks may perform a soft or hard credit check when opening a new account, especially if you’re applying for an overdraft or credit facilities.

Customers should avoid missing payments during the switch and keep an eye on the first few weeks of activity in their new account.

Conclusion

Nationwide’s current combination of a £175 switching incentive and a potential £100 Fairer Share Payment makes it one of the most lucrative bank switching offers in the UK for 2025.

With straightforward eligibility requirements, a fast switching process, and the backing of a trusted financial brand, customers can enjoy real financial benefits for simply moving their banking relationship.

If eligible, there’s no better time to make the switch and take advantage of up to £275 in free cash.

FAQs

How long does it take to receive the switching bonus from Nationwide?

The bonus is typically paid within 10 days after completing all switch requirements, including direct debits, pay-in, and debit card use.

Can existing Nationwide customers receive the £175 bonus?

No, the switching bonus is for new current account customers only. Existing customers may be eligible for the Fairer Share Payment instead.

What happens if I don’t meet all switching conditions?

Failure to meet any of the listed conditions such as the pay-in or debit card use may result in disqualification from the bonus.

Do I need to close my old bank account to qualify?

Yes, the Current Account Switch Service requires your old account to be closed as part of the process.

Is the Fairer Share Payment taxable income?

No, the Fairer Share Payment is generally not taxable, but customers are advised to confirm with HMRC for personal tax circumstances.

Can you get both the switching bonus and Fairer Share Payment together?

Yes, provided you meet the eligibility for both, you can receive up to £275 by combining them.

What happens if I cancel after receiving the bonus?

There are no clawbacks if you leave after receiving the bonus, but Nationwide may consider this behaviour when offering future promotions.