The debate around a windfall tax on UK banks has gained momentum following recent budget discussions, sparking sharp movements in financial markets.

Within a single trading session, the sector lost over £6bn in value as investors reacted to growing speculation about a fresh levy on lenders.

The Institute for Public Policy Research (IPPR) has intensified pressure by recommending that the government recoup profits banks received from past economic interventions, particularly quantitative easing.

This article explores the reasons behind the market reaction, the historical context of windfall taxes, and what the future may hold for the banking sector.

What Triggered The Fall In UK Bank Shares After The Budget Talks?

The banking sector’s decline in share value was swift and severe following renewed speculation about a windfall tax in the upcoming budget. Over £6bn was wiped off the sector’s market value in just one trading session.

Immediate Market Reaction

NatWest, Lloyds, Barclays, and HSBC were the most affected, with share prices dropping between 1% and 5%.

This immediate reaction was largely driven by investor concerns that a windfall tax could reduce banks’ profitability, dividends, and future capital growth potential.

Political Context Behind The Decline

The speculation was fuelled by the Institute for Public Policy Research’s recommendations, which suggested taxing the “excess” gains banks have enjoyed from quantitative easing.

With the government facing a budget deficit of around £40bn, the proposal was seen as a credible option, heightening market fears that it may soon become policy.

Broader Economic Impact

The fall in bank shares also reflected broader investor unease. Banks are seen as a barometer for the UK economy, so any threat to their stability raises concerns about reduced lending, slower investment, and weaker growth prospects across multiple sectors.

Why Is The IPPR Calling For A Windfall Tax On UK Lenders?

The Institute for Public Policy Research (IPPR) has been central to the debate, producing a report that suggests banks are reaping undue financial benefits from the way quantitative easing (QE) was designed after the 2008 crisis.

The mechanism works as follows:

- The Bank of England purchased £895bn worth of bonds from UK banks during QE.

- Banks were credited with reserves at the Bank of England.

- These reserves accrue interest at the base rate, currently 4%.

Because the Bank of England now pays higher interest on reserves than it receives from its bond holdings, this arrangement results in an annual cost to the taxpayer of around £22bn.

The IPPR argues that this effectively represents a “windfall” to banks, which should be reclaimed through taxation and redirected into public services or economic support programmes.

How Have Previous Windfall Taxes Shaped UK Banking Policy?

Windfall taxation has been used at various points in modern UK history, particularly when governments sought additional revenue during economic strain.

The 1981 Bank Deposit Levy

Introduced under Margaret Thatcher’s Conservative government, this levy was imposed directly on banks’ deposits.

It was controversial but raised substantial funds at a time of recession. The precedent demonstrated that banks could be targeted when public finances demanded it, despite opposition from the financial sector.

The 1997 Labour Windfall Tax On Privatised Utilities

The Blair government targeted utility companies, arguing that they had benefited disproportionately from privatisation.

The revenue generated was used to fund employment and welfare initiatives, showing how windfall taxes could be justified as a tool for redistribution and social investment.

The 2022 Energy Profits Levy

More recently, the Conservative government introduced a windfall tax on oil and gas producers during the energy crisis.

The proceeds were channelled into helping households cope with soaring bills. This example reinforced the political attractiveness of windfall taxation when public pressure demands corporate contributions.

Lessons For Today’s Banking Sector

These historical cases underline a pattern: windfall taxes tend to emerge during periods of financial hardship or political pressure.

While they raise significant short-term revenue, they also generate concerns about long-term investment, competitiveness, and the risk of overburdening critical sectors.

For banks today, the echoes of past policies suggest that renewed taxation could be more than just political rhetoric it could become reality.

What Does A New Bank Levy Mean For UK Public Finances?

Chancellor Rachel Reeves is grappling with a public finance shortfall estimated at £40bn. A windfall tax on UK banks could form part of a wider revenue strategy designed to stabilise the budget while supporting Labour’s economic agenda.

If implemented, the funds raised from banks could be allocated to:

- Expanding healthcare and education funding

- Supporting households with rising living costs

- Reducing government debt servicing obligations

Potential Fiscal Impact Of A Bank Levy

| Policy Option | Estimated Revenue | Possible Allocation |

| Bank windfall tax (IPPR model) | £10bn–£15bn annually | Healthcare, education, cost-of-living support |

| Property tax reform | £5bn–£7bn annually | Local government and housing projects |

| Landlord rental income tax changes | £2bn–£4bn annually | Affordable housing and welfare programmes |

Although these figures are subject to political negotiation and economic variables, they demonstrate the scale of contribution a windfall tax on banks could make.

It is unlikely to fill the £40bn gap entirely, but it could be a significant component of the overall fiscal strategy.

How Are Investors And Analysts Reacting To The Windfall Tax Proposal?

The announcement of a potential windfall tax on UK banks sparked an immediate response from financial markets and industry experts.

While the banking sector has faced taxation debates before, the timing amid fragile economic recovery has amplified concerns.

Investors and analysts are carefully weighing both the short-term risks and long-term implications.

Immediate Investor Concerns

The sharp decline in bank shares following budget discussions demonstrated how sensitive investors are to fiscal policy shifts.

Many view the proposed levy as an additional burden that could eat into bank profitability, reduce dividends, and limit reinvestment.

This concern is particularly acute for income-focused investors who rely on banking stocks for steady returns.

Analysts’ Views On Political Risk

Financial analysts have highlighted the political motivation behind the proposal. Neil Wilson, a strategist at Saxo Markets, noted that banks are “easy pickings politically,” making them a convenient target for revenue-raising measures.

However, he also questioned whether this approach aligns with Labour’s broader pro-growth strategy, as restricting bank lending could stifle economic expansion.

Market Strategy And Overreaction

Other analysts, such as Richard Hunter from Interactive Investor, cautioned that while the rumours of a windfall tax are serious, markets may have exaggerated the immediate risks.

According to Hunter, the prospect of new taxation does not necessarily mean it will be implemented in the harshest possible form. Still, the uncertainty alone is enough to cause volatility and erode short-term confidence.

Broader Financial Sector Sentiment

Beyond equity markets, there are concerns within the wider financial services industry. Some argue that repeated speculation about sector-specific taxation risks undermining the UK’s attractiveness to foreign investors.

The City of London’s status as a global financial hub depends heavily on stability and predictability, both of which are threatened when tax policies appear politically driven.

The Balance Between Revenue And Growth

Ultimately, analysts agree that the debate over windfall taxation is a balancing act. On one hand, the government must raise revenue to address fiscal pressures.

On the other, it must avoid undermining confidence in a sector that plays a pivotal role in financing growth. Investors remain cautious, waiting for further clarity in the upcoming budget before making long-term decisions.

Could A Windfall Tax Harm The UK’s Financial Stability And Growth?

A fresh levy on banks may provide a short-term fiscal boost but carries potential long-term risks. Policymakers must weigh these carefully to avoid undermining the stability of the financial system.

The key risks include:

- Reduced Lending Capacity: Lower profits could prompt banks to scale back lending, particularly to small businesses that rely on accessible credit.

- Investor Sentiment: Repeated speculation about taxation could make the UK less attractive to international investors, limiting capital inflows into the financial sector.

- Sector Resilience: Additional levies may reduce the ability of banks to build capital reserves, which are vital for absorbing future economic shocks.

Maintaining confidence in the financial sector is critical. The City of London remains one of the world’s leading financial hubs, and a policy that erodes its competitive edge could have unintended economic consequences.

What Might The Future Hold For UK Banks Under Labour’s Tax Agenda?

Labour’s fiscal strategy is still evolving, but speculation around the windfall tax highlights the government’s willingness to explore new ways of addressing its financial challenges.

Alongside banks, property ownership and landlord rental income are also being reviewed as potential areas for additional revenue.

The ultimate direction will depend on:

- The depth of the fiscal shortfall revealed in the autumn budget

- Labour’s political calculations on how far to push redistribution

- The reaction from markets and the financial services sector

For UK banks, the uncertainty is unlikely to abate until the government clarifies its stance. In the meantime, share price volatility and investor caution are expected to persist.

Conclusion

The debate over a windfall tax on UK banks highlights the tension between fiscal responsibility and economic growth.

While the measure could provide much-needed revenue for public services and reduce financial pressures, it risks unsettling investors and constraining lending.

History shows that windfall taxes can be politically effective, but their long-term impact is less certain.

The coming months will reveal whether Labour pursues this route, shaping the outlook for banks and the wider UK economy.

Frequently Asked Questions

Why are UK banks being targeted for a windfall tax now?

Banks are under scrutiny because they received substantial benefits from quantitative easing and now earn significant income from central bank reserves, while the government faces a large budget shortfall.

How would a windfall tax affect ordinary bank customers?

If introduced, banks might reduce lending or pass on some of the costs through higher fees or lower savings rates, indirectly impacting customers.

Is the windfall tax on banks similar to the energy sector tax?

Yes, both are designed to reclaim excess profits from sectors that benefited from external circumstances, though the mechanisms and scale differ.

What role did quantitative easing play in banks’ current profits?

Quantitative easing gave banks reserves that now earn interest from the Bank of England. As rates rose, these reserves generated more income, contributing to profits targeted by the proposed tax.

Could foreign investors pull back from UK banks due to tax risks?

There is a risk that uncertainty around future tax policy could reduce international investment in the UK’s financial sector.

How likely is it that Labour will introduce a bank levy in the 2025 budget?

While no decision has been confirmed, the government’s significant fiscal challenges make it a strong possibility, though the final form may vary.

What alternatives to a windfall tax are being discussed to fix the deficit?

Other options include reforms to property taxation, changes to landlords’ rental income taxation, and broader adjustments to wealth and income tax policies.

- Windfall Tax On UK Banks: Why Lenders’ Shares Are Tumbling After Budget Talks?

Prompt:

A wide-aspect digital illustration of the London financial district with major UK bank logos (NatWest, Barclays, Lloyds, HSBC) subtly visible on skyscrapers. Stock market graphs in the background showing a sharp downward red trend line, symbolising falling bank shares. Professional editorial style, clean lines, muted business colours.

- What Triggered The Fall In UK Bank Shares After The Budget Talks?

Prompt:

Illustration of traders looking at large stock exchange screens with falling red share prices and UK pound symbols. A newspaper headline reading “Budget Talks” is visible on a desk. The mood should reflect concern and urgency. Wide-aspect ratio, modern financial news style.

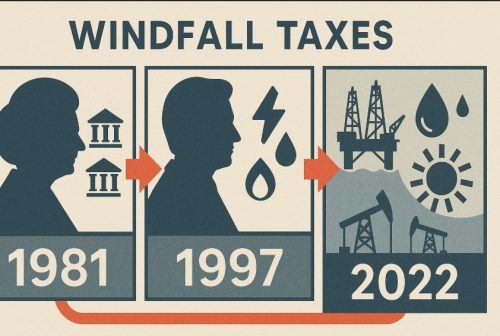

- How Have Previous Windfall Taxes Shaped UK Banking Policy?

Prompt:

A timeline-style wide illustration showing three eras:

- 1981 with Margaret Thatcher silhouette and bank building icons.

- 1997 with Tony Blair silhouette and utility company symbols.

- 2022 with oil rigs and energy sector icons.

Arrows connecting the periods to represent the history of windfall taxes in the UK. Neutral infographic style, clear, professional, and educational.

- How Are Investors And Analysts Reacting To The Windfall Tax Proposal?

Prompt:

Illustration of a roundtable with investors, analysts, and economists debating. Speech bubbles show symbols: rising tax icon, falling bank icon, and balance scales symbolising fairness vs growth. Stock charts in the background with fluctuating red and green lines. Editorial cartoon-like realism with a professional tone.

- What Might The Future Hold For UK Banks Under Labour’s Tax Agenda?

Prompt:

Futuristic wide illustration of the Bank of England and UK Parliament under cloudy skies. A road splits into two paths: one marked “Growth” with green upward arrows, and the other marked “Tax Burden” with heavy weights symbolising levies. Labour Party red colour tones subtly integrated into the background. Forward-looking and conceptual style.