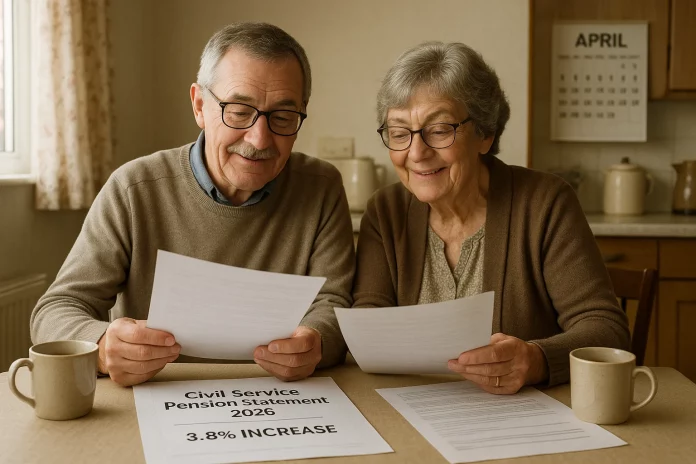

The UK government has confirmed a 3.8% increase in Civil Service pensions, effective from 6 April 2026.

This rise, announced after the Office for National Statistics (ONS) published the September 2025 Consumer Prices Index (CPI) figures, will come as a welcome change for pensioners following the previous year’s lower-than-expected 1.7% increase.

Civil Service pensions are tied directly to inflation through the CPI measure, ensuring pensions retain their purchasing power over time.

What Is the Civil Service Pension Increase for 2026 and When Does It Take Effect?

The Civil Service pension will increase by 3.8% from 6 April 2026. This annual adjustment is applied to pensions that have been in payment for a full 12 months.

It is based on the Consumer Prices Index (CPI) figure for September of the previous year, which the Office for National Statistics (ONS) released in October.

This 3.8% increase will impact thousands of retired civil servants across the UK and reflects the inflationary environment experienced during the year.

Pensioners who have not been in receipt of their pension for a full 12 months will receive a proportion of the increase, calculated on a monthly basis.

This rise will offer financial relief to pensioners following a lower 1.7% increase in April 2025.

The difference between the two years highlights the sensitivity of the pension indexation system to changes in CPI.

How Is the Civil Service Pension Increase Calculated Each Year?

Civil Service pensions are adjusted every April based on the rate of inflation as measured by the CPI in the preceding September.

This approach is governed by the Social Security Administration Act 1992. The CPI is seen as a more accurate measure of inflation for public sector indexing compared to the Retail Prices Index (RPI), which was used before 2011.

Here is a table showing how the September CPI has determined pension increases in recent years:

| Year | CPI (September) | Civil Service Pension Increase |

| 2022 | 3.1% | 3.1% |

| 2023 | 10.1% | 10.1% |

| 2024 | 6.7% | 6.7% |

| 2025 | 1.7% | 1.7% |

| 2026 | 3.8% | 3.8% |

The CPI figure is published by the ONS each October. The pension increase is confirmed shortly afterwards by the Cabinet Office.

These increases apply to Civil Service pensions in payment and also impact preserved pensions which are adjusted until they are drawn.

Why Is the 2026 Pension Increase Higher Than in 2025?

The 2026 increase of 3.8% is a significant rise compared to 2025’s 1.7% increase. This change is directly tied to the movement in the CPI between September 2024 and September 2025.

In 2025, inflation was unexpectedly low due to stabilising energy prices and a reduction in supply chain issues.

However, economic conditions in mid to late 2025 led to a rebound in inflation. Rising utility costs, increased council tax rates, and continued wage growth contributed to the higher CPI figure for September 2025.

Although analysts had predicted a CPI rise of around 4% by September, the final figure came in slightly below expectations at 3.8%.

Despite this, the increase still represents an improvement over the previous year’s adjustment and is welcomed by most pensioners.

Who Will Benefit From the Civil Service Pension Rise in 2026?

The confirmed 3.8% Civil Service pension increase for 2026 will not be applied universally in the same way to every pensioner.

There are specific eligibility rules and conditions that determine how and to what extent individuals benefit from the increase.

Eligibility for the Full 3.8% Increase

The full increase will only apply to Civil Service pensions that have been in payment for at least 12 months by 6 April 2026.

This means that those who began receiving their pension on or before 6 April 2025 will receive the full uplift.

This rule ensures that the increase accurately reflects a full year’s worth of inflation since the last adjustment.

Pro-Rata Adjustments for Newer Pensioners

For those whose pension has been in payment for less than a year, the 3.8% increase will not be granted in full. Instead, the increase is calculated on a monthly pro-rata basis.

This means the percentage increase is reduced based on how long the pension has been in payment before the April 2026 implementation date.

For example:

- If a pension began in October 2025, the recipient would receive 6/12ths of the full 3.8% increase, equating to 1.9%.

- If it started in January 2026, they would receive 3/12ths, or approximately 0.95%.

This approach ensures fairness while still recognising the shorter duration the pension has been in payment.

Eligible Groups:

The increase will apply to the following categories of pensioners:

- Retired Civil Servants: Former government employees who are in receipt of a pension under the Classic, Classic Plus, Premium, Nuvos, or Alpha schemes.

- Survivors and Dependants: Widows, widowers, civil partners, and eligible children receiving a survivor’s pension following the death of a Civil Service scheme member.

- Preserved Pension Holders: Individuals who have left the Civil Service but are entitled to a pension at a later date. These pensions will also be uprated annually in line with CPI until they come into payment.

- Ill-health Retirees: Those who retired early on medical grounds and are receiving pension payments.

It is important to note that active members (those still working in the Civil Service and contributing to their pensions) will not see the increase reflected in their current salaries.

Instead, their final pension calculation at retirement will take these annual uplifts into account.

Scheme-Specific Conditions:

While most members are covered by one of the unified pension schemes under the Civil Service Pension arrangements, each scheme (such as Alpha or Classic) has slight differences in terms of how benefits accrue and how increases are applied. However, all follow the same CPI-linked uprating once the pension is in payment.

Overall, the 3.8% increase will benefit a broad group of individuals across different life stages, with specific adjustments depending on when payments commenced.

How Will the 2026 Increase Affect Civil Service Pensioners Financially?

The 3.8% increase in Civil Service pensions from April 2026 will have a measurable impact on pensioners’ monthly incomes, but the extent of this impact will vary based on individual pension amounts, lifestyle, and inflationary pressures on essential costs.

Real-World Financial Impact

For pensioners on modest to average Civil Service pensions, a 3.8% increase could result in a noticeable monthly uplift. For example:

| Annual Pension Before Increase | Monthly Pension | Monthly Increase (3.8%) | New Monthly Pension |

| £10,000 | £833 | £31.66 | £864.66 |

| £15,000 | £1,250 | £47.50 | £1,297.50 |

| £20,000 | £1,667 | £63.34 | £1,730.34 |

This increase, while helpful, must be viewed in the context of rising living expenses across the UK.

Cost Pressures Facing Pensioners

Many retired public servants continue to face financial strain due to increases in several unavoidable household expenses:

- Council Tax: Many local authorities introduced above-inflation Council Tax hikes in 2025, and further increases are expected in 2026.

- Energy Costs: Although energy markets have stabilised, the price of gas and electricity remains significantly higher than pre-2020 levels, especially for those not on fixed-rate tariffs.

- Water and Sewage Bills: UK water companies have announced increases to offset infrastructure investment and environmental compliance.

- Food and Essentials: Global supply chain issues, currency fluctuations, and domestic inflation continue to drive up food prices and basic living costs.

While a 3.8% increase helps pensioners manage these pressures, it may not fully offset the cumulative increases in essential living costs that have taken place over the past few years.

Commentary from the CSPA

David Luxton of the Civil Service Pensioners’ Alliance (CSPA) acknowledged the increase as a step forward but stressed that pensioners remain under pressure.

He highlighted that the previous year’s 1.7% increase had left many struggling and that the new figure, while welcome, still requires careful household budgeting.

Long-Term Financial Planning Considerations

For Civil Service pensioners, the annual CPI-linked increase offers some certainty and predictability. However, it is important to recognise that:

- CPI does not always reflect the actual spending patterns of older people, especially regarding health care, heating, and housing.

- Some pensioners with additional income sources may find themselves subject to increased income tax, particularly if their total income crosses the personal allowance threshold.

The 3.8% increase can help maintain purchasing power but does not equate to financial security for all.

Pensioners are advised to review their annual income, consider potential tax implications, and ensure they are claiming all available benefits, such as Pension Credit or Council Tax Reduction.

What’s the Connection Between State Pension and Civil Service Pension Increases?

While Civil Service pensions follow CPI inflation directly, the State Pension is governed by the Triple Lock. This policy ensures that the State Pension rises each year by the highest of:

- Consumer Prices Index (CPI) inflation

- Average earnings growth

- 2.5%

For April 2026, average earnings rose by 4.8% during the review period (May to July 2025). This means that the State Pension is expected to increase by 4.8%, surpassing the 3.8% Civil Service pension increase.

The gap between the two increases highlights the differences in calculation methods and the unique position of the State Pension within government policy.

Civil Service pensions, despite being generous compared to some private sector schemes, are not protected by the Triple Lock.

This means that pensioners receiving both a Civil Service pension and the State Pension will see two different increases applied to their income in 2026.

What Are the Broader Economic Factors Behind the 2026 Pension Adjustments?

Several key economic indicators influenced the CPI figure for September 2025 and the resulting pension increase.

The UK experienced a period of stabilisation after a volatile 2022 and 2023, yet some inflationary pressures persisted into 2025.

Influencing factors included:

- A mild recovery in global oil prices, affecting energy bills

- Above-average wage growth in the public and private sectors

- Increased food prices due to import delays and trade issues

The Bank of England maintained interest rates to combat inflation, but pressures from wage demands and geopolitical risks created a moderate inflation environment by mid-2025.

Public spending controls and cautious fiscal planning by the government limited additional support for pensioners beyond the CPI-linked increase.

There is no separate uplift or discretionary increase for Civil Service pensions beyond the CPI figure.

Will the State Pension Age Increase Impact Civil Service Pensions?

Yes, from April 2026, the State Pension age will begin increasing from 66 to 67 on a phased basis. This change affects Civil Service pensions because the Normal Pension Age (NPA) in many modern Civil Service schemes is aligned with the State Pension age.

Those who joined the Civil Service after April 2015 are likely to be part of the alpha pension scheme, where the NPA mirrors the State Pension age.

As that age increases, so too does the point at which members can access their full Civil Service pension without actuarial reduction.

The phased increase will be completed over a two-year period. This change will not affect those who have already retired or those in legacy schemes with a lower NPA.

However, for many current employees, the age at which they can retire with an unreduced pension will increase.

Here is a breakdown of the phased changes:

| Date Range | State Pension Age | Impact on Civil Service Pension Age |

| Before Apr 2026 | 66 | NPA = 66 |

| Apr 2026 – Mar 2028 | Rising from 66 to 67 | NPA increases accordingly |

| From Apr 2028 | 67 | NPA = 67 |

This alignment of pension ages ensures consistency between State and Civil Service pensions but requires individuals to plan for a potentially longer working life.

How Do Civil Service Pension Increases Compare with Other Public Sector Pensions?

Most public sector pensions, including those for NHS workers, teachers, firefighters and the police, follow the same CPI-linked indexation policy. The key differences lie in scheme structures, legacy benefits and member contributions.

Civil Service pensions are generally seen as stable and well-administered, but they are not immune to broader public sector reform.

Other schemes also received a 1.7% increase in 2025 and will benefit from the 3.8% uplift in 2026.

However, the exact impact can vary depending on:

- Whether the member is in an active, deferred or retired status

- The specific public sector scheme (e.g. NHS vs. Civil Service)

- Whether the scheme is defined benefit or contribution-based

The consistency in applying CPI helps preserve parity across sectors, but additional scheme features such as survivor benefits, early retirement options and contribution rates may vary significantly.

Conclusion

The confirmed 3.8% Civil Service pension increase for 2026 offers some financial relief following a lower increase in the previous year.

However, pensioners will still need to plan carefully as inflation, rising living costs, and changes in pension age continue to impact retirement income.

With the State Pension increasing at a slightly higher rate and pension ages shifting upward, individuals approaching retirement should remain informed and proactive in managing their financial future.

Frequently Asked Questions

What determines the annual increase in Civil Service pensions?

Civil Service pensions increase each April based on the September CPI figure from the previous year. This link is legislated under the Social Security Administration Act.

Is the 3.8% pension rise in 2026 guaranteed for all pensioners?

Only pensions in payment for at least 12 months by April 2026 will receive the full 3.8% increase. Those who retired within the last year will receive a pro-rata increase.

How is the Civil Service pension different from the State Pension?

Civil Service pensions are linked to CPI inflation, while the State Pension increases based on the Triple Lock system. They are separate benefits with different eligibility and rules.

Will the 2026 pension increase affect taxes or benefits?

Pension increases could affect tax thresholds or benefit entitlements depending on individual circumstances. Pensioners should review their income annually or consult with a financial advisor.

How does CPI impact public sector pensions overall?

CPI is used to index most public sector pensions, ensuring that retirement income maintains purchasing power relative to inflation. Higher CPI means larger increases.

What if I retired less than 12 months ago do I still get the full increase?

No, you will receive a proportion of the 3.8% increase based on how long your pension has been in payment. The increase is calculated monthly on a pro-rata basis.

What future changes might affect Civil Service pensions in the UK?

Potential future changes include further adjustments to the pension age, changes in inflation calculation methods, and broader public sector pension reforms in response to fiscal pressures.