Nationwide Building Society has issued a final reminder to millions of its members, urging them to act before the end-of-year deadline to claim their £50 bonus payment.

This one-off payment, part of “The Big Nationwide Thank You”, was distributed to over 12 million eligible customers in recognition of their continued loyalty during a transformative period for the society.

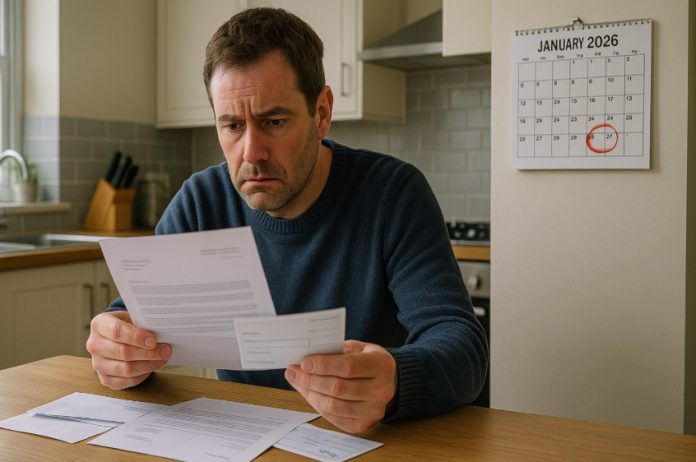

With the final date to deposit issued cheques set for 1 January 2026, members who have yet to cash in are at risk of missing out entirely.

This article provides a complete overview of the £50 bonus scheme, including eligibility criteria, payment details, claim methods, and important deadlines.

What is the Nationwide 50 Bonus and Why Was It Issued?

The Nationwide 50 bonus refers to a one-time £50 payment provided by Nationwide Building Society to eligible members as part of its Big Nationwide Thank You campaign.

This initiative was announced shortly after the building society finalised its acquisition of Virgin Money on 1 October 2024.

Nationwide used this moment to thank over 12 million of its members for their loyalty and support, especially in enabling the society’s financial strength that made the acquisition possible.

The gesture, totalling more than £600 million in payments, is considered one of the most significant customer reward programmes in the UK banking sector.

The bonus is distinct from other rewards such as the Fairer Share Payment, focusing solely on this historic milestone in the society’s development.

It also reinforced Nationwide’s mutual status, as the payout was made entirely to members rather than external shareholders or investors.

Who Was Eligible to Receive the Nationwide £50 Bonus Payment?

Eligibility for the £50 payment was based on membership status and activity within a specified time frame.

Customers needed to meet certain conditions relating to their accounts and transactions.

To qualify:

- Members had to be part of Nationwide as of 30 September 2024

- They also had to still be members when the payment was issued

In addition, members must have met one of the following during the 12 months leading up to 30 September 2024:

- At least one qualifying transaction in a current or savings account

- A balance of £100 or more across one or more Nationwide current or savings accounts

- At least £100 owed on a residential mortgage with Nationwide

Customers who switched to a Nationwide current account between 1 July and 30 September 2024 using the Current Account Switch Service also qualified for the payment.

Some accounts and scenarios were excluded based on the society’s terms and conditions. For instance, business accounts or accounts that were not active during the qualifying period may not have been eligible.

How Were Nationwide 50 Bonus Payments Distributed to Customers?

Nationwide ensured the distribution of the £50 payments was simple and automated. Most members received the payment directly into their existing Nationwide account, while others were issued cheques if no eligible account was found for electronic transfer.

The payment method depended on the customer’s existing relationship with the building society:

| Payment Scenario | Method of Payment |

| Customer had an eligible current or savings account | £50 paid directly into that account |

| Customer had only a residential mortgage | £50 paid into the bank account used for mortgage Direct Debit (if in their name) |

| No eligible account for direct payment | £50 cheque sent by post |

The building society notified customers of the payment either through digital channels or by post. No application was necessary, and the bonus was credited automatically.

Members were encouraged to check their accounts for the £50 or look for a cheque in the post if they hadn’t received the deposit.

What is the Deadline to Claim the Nationwide £50 Bonus Cheque?

Although most members received their bonus via direct deposit, those who were sent cheques must take action before the final deadline.

Nationwide has confirmed that all cheques must be deposited or cashed by 1 January 2026.

After this date, cheques will become void. The building society has stated it will assess unclaimed payments on a case-by-case basis, but there is no guarantee that the payment will be honoured beyond the deadline.

The urgency of this final date is particularly important for members who may have misplaced or forgotten about their cheque. The society recommends that customers:

- Check any post received from Nationwide between late 2024 and early 2025

- Search for unbanked cheques in paperwork, drawers or other storage

- Contact Nationwide support if they believe a cheque was never received

Depositing the cheque before the deadline is the most reliable way to ensure receipt of the £50 bonus. This avoids any complications or potential loss of eligibility due to delays or lost documents.

How Can You Check If You’re Eligible for the £50 Nationwide Payment?

Nationwide aimed to make the eligibility and notification process for the £50 bonus as straightforward as possible.

However, with millions of members involved and payments issued in different formats, some customers may be unsure whether they qualified or if they’ve received their reward.

Understanding the Eligibility Criteria

Eligibility was primarily based on membership status as of 30 September 2024. A member also needed to hold qualifying products or balances during the 12 months leading up to that date. The conditions included:

- Having a qualifying transaction on a current or savings account

- Holding at least £100 in deposits across Nationwide accounts

- Owing £100 or more on a Nationwide residential mortgage

- Completing a switch to a Nationwide current account using the Current Account Switch Service between 1 July and 30 September 2024

If you met one of these criteria and were still a member when payments were made, you were likely eligible.

Where to Find Confirmation from Nationwide?

Nationwide communicated eligibility to customers via several channels:

- In-app notifications for mobile banking users

- Emails or letters sent to registered contact addresses

- Bank statements showing a £50 credit

- A cheque issued by post

Members who actively use the Nationwide app or regularly check email may have already seen confirmation. Those who do not frequently use digital services might have received a letter or cheque instead.

Verifying Eligibility Through Nationwide’s Website or Support

Nationwide’s official website includes a dedicated section about The Big Nationwide Thank You. Members can find:

- A summary of the eligibility criteria

- Details about how payments were made

- Instructions on what to do if they didn’t receive a payment

If you’re still uncertain, the best course of action is to contact Nationwide customer support directly.

A representative can confirm whether your account qualified and if a payment was made. They may ask for:

- Your account number or customer ID

- The type of account(s) you held during the qualifying period

- The date you became a member and any changes to your account status

Prompt action is advisable, especially as the cheque deposit deadline approaches.

Is the Nationwide 50 Bonus Different from the Fairer Share Payment?

Yes, the £50 bonus is a separate initiative from Nationwide’s annual Fairer Share Payment. Although both schemes aim to reward member loyalty, they serve different purposes and are based on different financial events.

The table below highlights the key differences between the two:

| Feature | The Big Nationwide Thank You | Fairer Share Payment |

| Trigger Event | Acquisition of Virgin Money | Annual profits and performance |

| Amount | £50 | Variable (based on earnings) |

| Frequency | One-off (2024–2025) | Annually (where applicable) |

| Eligible Members | Based on 2024 membership | Based on yearly account activity |

Receiving one payment did not exclude members from receiving the other, provided they met each programme’s separate criteria.

Why is Nationwide’s £50 Bonus Considered a Significant Customer Loyalty Reward?

The Nationwide £50 bonus was not just a promotional gimmick or limited-time offer. It was one of the largest member-focused reward initiatives ever undertaken by a UK financial institution.

The scale, timing and intent behind it underline the society’s commitment to putting members first.

A Reward Built on Mutual Principles

As a mutual building society, Nationwide is owned by its members.

This business model allows profits to be reinvested or returned to members, rather than distributed to shareholders. The Big Nationwide Thank You is a direct result of this mutual structure.

By distributing over £600 million to more than 12 million members, Nationwide reaffirmed its foundational principle: to benefit members directly.

Rather than introducing exclusive offers for new customers or focusing on profit-based incentives, the society rewarded loyalty and long-term membership.

Inclusion Beyond Just Current Account Holders

Another standout feature of the £50 bonus was its wide-reaching eligibility. Unlike typical switching offers or targeted reward schemes, Nationwide’s initiative recognised a broad range of members, including:

- Savers

- Mortgage holders

- Customers who had relatively low balances

- Members who joined through switching services

This inclusive approach ensured that long-standing customers who may not be actively switching or transacting still benefited from the reward.

Financial Impact and Public Reception

The £50 payment, while modest on an individual level, represented a significant financial move by Nationwide.

In an era where many banks are tightening costs, reducing branch services or offering minimal interest rates, Nationwide chose to return funds to its customers.

The public response was largely positive. Media coverage highlighted the move as a refreshing example of customer-centric banking.

Many members viewed it as a tangible expression of appreciation rather than a token gesture.

Comparison to Other Loyalty Schemes

In contrast to other UK banks, where loyalty schemes are often limited to cashback, introductory offers or rewards tied to premium accounts, Nationwide’s approach stood out in several ways:

- It was automatic for those who qualified

- It did not require sign-ups or special conditions

- It included a vast majority of the member base

This made the initiative feel less like a marketing campaign and more like a genuine thank you from the institution to the people who made its growth possible.

What Should You Do If You Miss the Nationwide Bonus Deadline?

Nationwide’s guidance is clear: all cheques must be cashed by 1 January 2026. After this, they are no longer valid.

Members who believe they missed the payment due to a lost cheque or communication error should act promptly.

In certain situations, Nationwide may review individual cases, especially where evidence of eligibility exists. However, this is not guaranteed and depends on internal policy.

It is recommended to:

- Contact Nationwide’s customer service team as soon as possible

- Provide member and account details to help locate the payment

- Confirm whether the payment was sent by cheque or direct deposit

Acting quickly gives members the best chance of reclaiming their bonus if they haven’t received or deposited it.

Final Thoughts

Nationwide’s £50 bonus is more than a financial reward; it’s a symbol of mutual trust between the society and its members.

It also stands as a strong example of how financial institutions can acknowledge customer loyalty in a tangible way.

However, time is running out. With the 1 January 2026 deadline approaching quickly, members who received a cheque but haven’t yet cashed it should do so without delay. A missed deposit could mean a lost reward.

Those unsure about their eligibility should take proactive steps to verify their status now and contact Nationwide directly if necessary.

FAQs About the Nationwide £50 Bonus

How can I confirm if my Nationwide account qualified for the bonus?

You can verify your eligibility by contacting Nationwide directly or checking through their website. Notifications were sent to eligible members, but if you didn’t receive one, it’s worth checking all your accounts.

What if I lost my £50 cheque from Nationwide?

If your cheque was lost or misplaced, contact Nationwide customer service as soon as possible. They may reissue the cheque depending on the situation and the time left before the 1 January 2026 deadline.

Are business accounts eligible for The Big Nationwide Thank You payment?

No, the bonus was only available to personal Nationwide members who met specific account and balance criteria.

Will the £50 bonus affect my benefits or taxes?

Typically, such bonuses do not impact means-tested benefits. However, the payment may be considered taxable interest in some cases. It’s advisable to consult with a financial advisor or HMRC for clarity.

Can I still get the £50 if I switched banks after September 2024?

No, eligibility required being a Nationwide member as of 30 September 2024 and still holding an account when payments were issued.

Is the Nationwide £50 reward a one-time payment?

Yes, the £50 bonus was a one-off payment tied specifically to the Virgin Money acquisition. It is separate from other ongoing reward schemes.

What if my payment was made to a closed or wrong account?

If the account was closed before the payment was issued, the funds may have been redirected or returned. Contact Nationwide to trace the payment and reissue it if applicable.