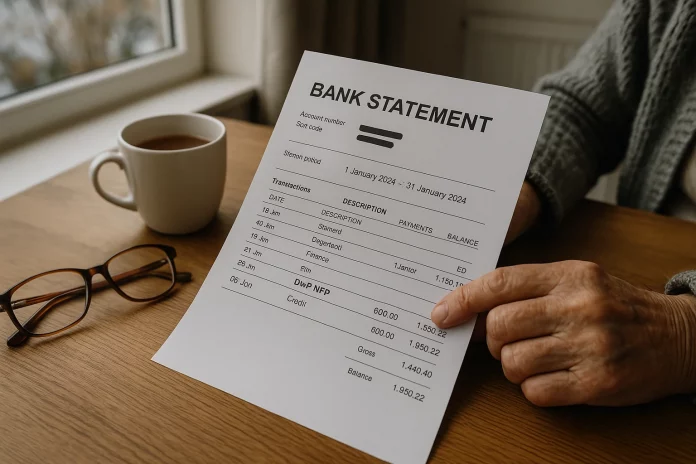

Understanding unexpected entries on your bank statement can be concerning, especially if you spot something like “DWP WFP”.

For many in the UK, particularly older adults, this payment can appear without prior notice. So what exactly does it mean?

This guide explores what “DWP WFP” means on your bank statement, why you’re receiving it, how much you might get, and what to do if you think you’re eligible but haven’t received it.

It also outlines the differences between the Winter Fuel Payment, Cold Weather Payment, and other similar support schemes.

What Does ‘DWP WFP’ Mean on a Bank Statement?

The appearance of “DWP WFP” on a UK bank statement indicates a payment from the Department for Work and Pensions relating to the Winter Fuel Payment.

The appearance of “DWP WFP” on a UK bank statement indicates a payment from the Department for Work and Pensions relating to the Winter Fuel Payment.

This is a government benefit designed to assist with the cost of heating homes during the coldest months of the year. The payment reference usually begins with the individual’s National Insurance number, followed by “DWP WFP”.

This code represents an annual, tax-free payment that supports eligible individuals, particularly pensioners, in meeting rising energy costs during winter. It is not a repayment or a loan but a financial support measure issued by the UK government.

The presence of this payment can often come as a surprise to recipients who did not apply for it, largely because it is distributed automatically to most eligible individuals.

Understanding the context behind this reference code can help avoid confusion or unnecessary concern when reviewing banking transactions.

Who Qualifies for the Winter Fuel Payment in the UK?

Eligibility for the Winter Fuel Payment is based on several key factors, primarily age, residency status, and the receipt of certain benefits.

To qualify for the 2025–2026 winter season, individuals must have been born on or before 22 September 1959 and must have resided in the UK during the qualifying week, which usually falls in mid-September.

Automatic payments are typically issued to individuals who:

- Receive the State Pension

- Are on certain social security benefits such as Pension Credit, Income Support, or income-based Jobseeker’s Allowance

Some people who do not receive qualifying benefits may still be eligible and can make a claim. This includes individuals who are:

- Living abroad in certain EEA countries or Switzerland

- Not receiving any benefits, but meet the age and residency requirements

If two people in the same household qualify, the payment may be split. However, if one person receives a benefit such as Pension Credit, the entire payment may go to them.

When Are Winter Fuel Payments Usually Made?

Winter Fuel Payments are generally issued between early November and late December. Payment dates may vary depending on when an individual qualifies and how their benefits are processed.

Winter Fuel Payments are generally issued between early November and late December. Payment dates may vary depending on when an individual qualifies and how their benefits are processed.

Some late payments may continue into January, especially for those who have recently qualified or moved abroad. It is important to monitor bank accounts during this period, as payments are made automatically in most cases.

The Department for Work and Pensions typically sends a letter confirming the amount and estimated date of payment. If the funds are not received by 28 January 2026, eligible individuals are advised to contact the Winter Fuel Payment Centre for assistance.

How Much Do You Receive from the Winter Fuel Payment?

The amount of the Winter Fuel Payment depends on the age of the recipient and their living arrangements.

Individuals receive different amounts depending on whether they live alone, with another qualifying person, or in a care home. The payment is intended to help offset the increased heating costs during the winter months.

Below is a breakdown of the payment amounts for the 2025–2026 winter season:

| Circumstance | Born Between 23 Sep 1944 and 22 Sep 1959 | Born on or Before 22 Sep 1944 |

| Lives alone (or no one else qualifies) | £250 | £300 |

| Lives with another qualifying person | £125 each | £150 each |

| Lives in a care home and not on Pension Credit | £125 | £150 |

The payment is made directly into the recipient’s bank account and is completely tax-free. It does not affect other benefits or income.

Why Did You Receive a DWP WFP Payment If You Didn’t Apply?

In many cases, eligible individuals receive the Winter Fuel Payment automatically. This is particularly common among those already claiming the State Pension or specific qualifying benefits. For this reason, it is possible to receive the payment without having submitted a formal application.

A few scenarios where this might occur include:

- You recently reached the qualifying age

- Your benefit status changed within the year

- You previously claimed, and the claim rolled over into future years

Automatic payments help ensure those who need assistance with winter fuel costs receive it promptly, without needing to navigate the claims process every year.

If you received a payment unexpectedly, it is likely due to an automatic eligibility trigger within the DWP system.

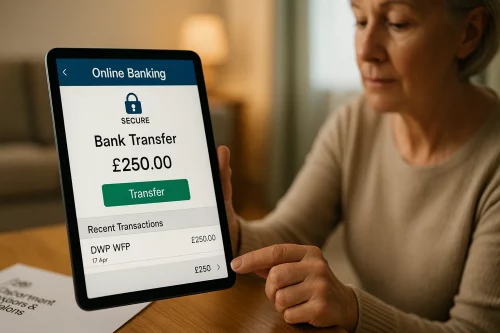

How Does the DWP Send Out the WFP Payment?

The Department for Work and Pensions issues the Winter Fuel Payment via direct bank transfer.

The Department for Work and Pensions issues the Winter Fuel Payment via direct bank transfer.

The transaction appears in bank statements under a unique reference, typically starting with the recipient’s National Insurance number, followed by the code “DWP WFP”.

This reference allows both the recipient and financial institutions to verify that the payment is legitimate. No additional action is required from the recipient if the payment arrives correctly.

The use of the National Insurance number in the payment reference ensures the payment is matched to the correct benefit record.

In cases where multiple individuals qualify at the same address, the DWP may adjust how payments are issued to avoid duplication. This ensures the system remains accurate and fair.

What Should You Do If You Think You’re Missing a WFP Payment?

If you believe you’re eligible for the Winter Fuel Payment but haven’t seen it appear on your bank statement, it’s important not to panic.

Delays can happen for a variety of reasons, but there are clear steps to follow to resolve the issue.

Step 1: Confirm Eligibility

Start by ensuring you meet all the necessary criteria.

To qualify for the 2025–2026 Winter Fuel Payment, you must:

- Have been born on or before 22 September 1959

- Have lived in the UK during the qualifying week (typically the third week of September)

- Be receiving the State Pension or other qualifying benefits (such as Pension Credit, Income Support, income-based Jobseeker’s Allowance or income-related Employment and Support Allowance)

If you live abroad, additional residency rules apply, and payments may be restricted to certain EEA countries and Switzerland.

Step 2: Check Your Bank Account and Letters from DWP

The DWP usually sends a letter in advance of the payment, confirming:

- The amount you’re due to receive

- The estimated payment date

- The bank account the payment will be sent to

Look for a transaction reference that includes your National Insurance number followed by “DWP WFP”.

If you’ve changed banks recently, your updated details must be registered with the DWP. If they are not, the payment may have gone to your old account or failed.

Step 3: Wait Until the Cut-off Date

Payments are made from early November through to the end of December, but some may continue into January depending on processing times.

If you haven’t received your payment by 28 January 2026, and you think you’re eligible, then it’s time to take action.

Step 4: Contact the Winter Fuel Payment Centre

If no payment has arrived by late January, contact the Winter Fuel Payment Centre. They can verify your eligibility, check if a payment was attempted, and reissue it if necessary.

You can contact them via:

- Phone: 0800 731 0160 (Monday to Friday, 8am to 6pm)

- Textphone: 0800 731 0176

- Relay UK: Dial 18001 followed by 0800 731 0160

When you call, be prepared to provide:

- Your National Insurance number

- Your bank details

- Any recent changes in address or benefit status

Taking timely action ensures that, if you’re eligible, the issue can be corrected before the winter season ends.

It also helps prevent longer delays in future years, as your updated details will be stored by the DWP for automatic payments.

How Is the Winter Fuel Payment Different from Cold Weather Payments?

While both the Winter Fuel Payment (WFP) and the Cold Weather Payment (CWP) aim to help with the costs of heating during colder months, they are completely separate schemes with different triggers, eligibility criteria, and payment structures.

While both the Winter Fuel Payment (WFP) and the Cold Weather Payment (CWP) aim to help with the costs of heating during colder months, they are completely separate schemes with different triggers, eligibility criteria, and payment structures.

Understanding the distinctions between the two is crucial to knowing what support you might qualify for, and why you may receive one and not the other.

Purpose and Timing

The Winter Fuel Payment is a planned, annual payment made to eligible pensioners or qualifying individuals to help with winter heating bills. It’s issued regardless of how cold the weather actually gets.

In contrast, the Cold Weather Payment is event-driven. It’s issued only when the average temperature in your area is recorded as, or forecast to be, 0°C or below for seven consecutive days.

The scheme is designed to help vulnerable individuals cope with sudden and extreme cold spells.

Eligibility Differences

The Winter Fuel Payment is mainly based on age and residency during a specific qualifying week. Most recipients are pensioners or older adults born before a cut-off date.

The Cold Weather Payment is linked to the receipt of certain benefits, such as:

- Pension Credit

- Income Support

- Income-based Jobseeker’s Allowance

- Income-related Employment and Support Allowance

- Universal Credit (with additional conditions)

It’s available to a wider demographic, including younger individuals and families, provided they meet the specific benefit-related criteria.

Amounts and Frequency

The Winter Fuel Payment provides a fixed annual amount ranging from £100 to £300, depending on the recipient’s age and circumstances.

Cold Weather Payments, however, are £25 per qualifying 7-day period of cold weather. It’s possible to receive multiple payments in one winter, depending on the severity and frequency of the cold weather in your area.

Key Comparison Table

| Feature | Winter Fuel Payment | Cold Weather Payment |

| Trigger | Age and residence during qualifying week | Temperature below 0°C for 7 days |

| Eligibility | Pensioners and older adults | People on certain income-based benefits |

| Payment Frequency | Once annually | Multiple payments possible per cold spell |

| Amount | £100–£300 depending on age/circumstances | £25 per 7-day cold period |

| Automatically Paid? | Yes, if receiving qualifying benefits | Yes, if on eligible benefits |

| Available to Pensioners? | Yes | Yes, if also on qualifying benefits |

| Affected by Weather? | No | Yes |

Can You Receive Both?

Yes, it is entirely possible to receive both payments in the same winter, provided you meet the eligibility criteria for each scheme. For example, a pensioner receiving Pension Credit could receive a Winter Fuel Payment plus multiple Cold Weather Payments during particularly cold weeks.

Application Process

- Winter Fuel Payment: Automatically paid in most cases, but some may need to apply (especially those not receiving benefits).

- Cold Weather Payment: Fully automatic for those receiving qualifying benefits. No application required.

These differences highlight the importance of understanding how each support scheme works. Being informed ensures you receive all the assistance you’re entitled to during the colder months.

Are There Other Energy-Related Benefits You Could Be Entitled To?

In addition to the Winter Fuel Payment, several other schemes exist to help UK residents manage their energy bills during the colder months.

These include both government and energy supplier-led initiatives, targeting different types of need.

Some of the key schemes include:

- Warm Home Discount: A one-off discount of £150 off electricity bills for qualifying households

- Cold Weather Payment: An additional £25 for each 7-day period of cold weather, triggered automatically

- Local Council Support: Some councils offer emergency assistance for those facing fuel poverty

- Supplier Grants: Many energy suppliers offer hardship funds for customers struggling to pay their bills

These schemes can often be used in conjunction with the Winter Fuel Payment, depending on the individual’s situation.

For those unsure about their entitlements, organisations such as Citizens Advice and Age UK provide free and confidential guidance.

Can You Opt Out or Return the Winter Fuel Payment?

There is no formal opt-out process for the Winter Fuel Payment, and the government does not require repayment from those who no longer need the support.

However, individuals who feel they do not require the payment can choose to donate it or repay it voluntarily.

Some may choose to support charities focused on fuel poverty, local warm hubs, or elderly care programmes.

While the payment is designed to help with increased winter energy costs, how it is used remains at the discretion of the recipient.

There is no penalty for receiving the payment, even if the money is not strictly needed, as eligibility is based on objective criteria rather than means testing.

Conclusion

Seeing “DWP WFP” on your bank statement is a positive sign, it means the UK Government is helping you with your winter heating costs through the Winter Fuel Payment.

Understanding what this payment is, who qualifies, and when to expect it can bring peace of mind.

If you’re eligible and haven’t received it, don’t hesitate to contact the Winter Fuel Payment Centre. Staying informed ensures you don’t miss out on support you’re entitled to, especially during the colder months.

FAQs

What is the DWP WFP payment actually for?

The Winter Fuel Payment is designed to help older residents in the UK cover rising heating costs during the winter months. It is issued annually by the Department for Work and Pensions.

Do I need to apply every year for the Winter Fuel Payment?

No, not if you’re already receiving the State Pension or other qualifying benefits. If you’re eligible but not receiving those benefits, you may need to claim it once.

Can I receive Winter Fuel Payment if I live abroad?

Yes, but only in certain countries with similar cold weather conditions. You must have a genuine and sufficient link to the UK and live in a qualifying EEA country or Switzerland.

What happens if I live in a care home?

If you’re in a care home and not receiving Pension Credit, you can still receive a reduced Winter Fuel Payment. Those receiving certain benefits while in care may not be eligible.

Is the Winter Fuel Payment taxable?

No, it is a tax-free benefit and does not affect your other entitlements or tax liabilities.

How can I check if a payment on my bank statement is genuine?

Legitimate Winter Fuel Payments will use your National Insurance number in the reference, followed by DWP WFP. If unsure, contact your bank or the DWP to verify the transaction.

What should I do if I get a suspicious message about DWP payments?

Do not click any links or share personal details. The DWP never asks for bank information via text or email. Report suspicious messages to Action Fraud UK.