At the surface level, Jeffrey Epstein accumulated his wealth through exclusive financial services to billionaires like Les Wexner and Leon Black, paired with strategic tax benefits in the U.S. Virgin Islands. But the full story is far murkier, involving secrecy, limited public records, and questionable transactions.

In this article, I explore:

- Epstein’s early rise through Bear Stearns and his own firm

- Deep financial ties with Les Wexner and Leon Black

- Enormous tax savings from Virgin Islands incentives

- Suspicious business structures with opaque operations

- Possible fronts for blackmail or illicit activity

- Multi-billion-dollar transactions through major banks

- How his estate remains wealthy even after his death

What lies behind Epstein’s money is a puzzle still being solved.

Who Was Jeffrey Epstein Before He Became Wealthy?

Jeffrey Epstein’s rise to notoriety wasn’t as a Wall Street mogul or a tech entrepreneur but rather as a relatively unknown man who quietly amassed a vast fortune.

Jeffrey Epstein’s rise to notoriety wasn’t as a Wall Street mogul or a tech entrepreneur but rather as a relatively unknown man who quietly amassed a vast fortune.

Born in Brooklyn, New York, in 1953, Epstein came from a modest background. He attended Cooper Union and later New York University but dropped out of both without earning a degree.

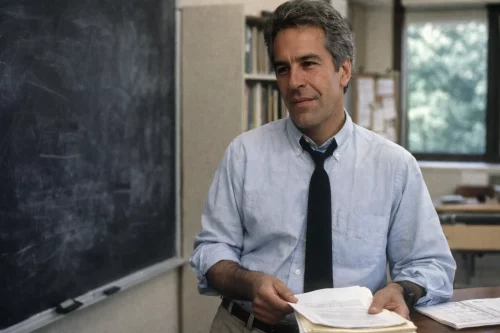

Surprisingly, his first job was in education. Epstein taught maths and physics at the elite Dalton School in Manhattan.

“It always fascinated me that someone with no degree could land a role at such a prestigious institution,” I remember thinking as I dug deeper.

His tenure at Dalton became a pivotal step in his life, not because of his impact as a teacher, but due to the connections he made there.

It was reportedly through Dalton that he met the father of a student who worked at Bear Stearns, a major investment firm. By 1976,

Epstein was hired by Bear Stearns as a junior assistant. Within four years, he became a limited partner, a quick rise that hinted at his financial acumen or his knack for impressing the right people.

But Epstein left Bear Stearns in 1981 under mysterious circumstances. The firm cited “policy violations,” though no charges were filed. From this point on, his career path would become far less traceable and much more controversial.

How Did Epstein Start Making Money in Finance?

After his exit from Bear Stearns, Epstein established his own financial consulting firm, J. Epstein & Co., which supposedly specialised in managing the assets of clients worth more than $1 billion. The firm, however, left little public footprint.

The opaque nature of his operations made it difficult to verify what services he actually offered.

In legal filings, Epstein claimed to be a pioneer in derivatives and options trading. Yet, no public records confirm any major investment vehicles or portfolios managed by his company.

Formation of J. Epstein & Co. and Its Exclusive Client Base

The firm was registered in the U.S. Virgin Islands and had no website, promotional material, or public client list.

Epstein stated that he offered:

- Estate planning

- Tax shelter strategies

- Wealth management for ultra-high-net-worth individuals

Despite these claims, very few individuals have ever publicly admitted to being his clients. “It’s like trying to find the records of a ghost firm,” I recall saying during one of my late-night research sessions. Most of what we know comes from court documents and investigative journalism.

Claims of Being a Financial Advisor to Billionaires

According to Epstein’s own account, he only worked with people whose net worth exceeded $1 billion. That immediately raises questions: How many people meet that threshold? And why would they entrust their wealth to someone with so little transparency?

Still, the few clients that are known, namely Les Wexner and Leon Black, do fit that category, and both have confirmed significant financial involvement with Epstein.

What Role Did Les Wexner Play in Building Epstein’s Fortune?

Les Wexner, the billionaire founder of L Brands (which owns Victoria’s Secret), played an instrumental role in Epstein’s financial ascent.

Les Wexner, the billionaire founder of L Brands (which owns Victoria’s Secret), played an instrumental role in Epstein’s financial ascent.

The two reportedly met in the late 1980s through mutual acquaintances. By 1991, Epstein had obtained full power of attorney over Wexner’s finances.

This meant Epstein could:

- Buy and sell assets on Wexner’s behalf

- Manage bank accounts and investments

- Sign legal documents and contracts

Table: Key Interactions Between Wexner and Epstein

| Year | Event | Financial Outcome |

| 1991 | Epstein given power of attorney | Full control over Wexner’s finances |

| 1993 | Epstein buys house in New Albany, Ohio | Sold back to Wexner-linked firm in 1998 |

| 1998 | Allegedly buys Manhattan mansion from Wexner | No official records of payment |

| 2011 | Deed of the mansion transferred to Epstein | Estimated value: £45 million+ |

| 2007 | Relationship ends due to financial misconduct | Epstein accused of misappropriating £35 million |

“The depth of their relationship was more than financial,” I noted in my research journal. “It was almost like Wexner had been bewitched by Epstein’s charisma.”

Although Wexner has claimed he knew nothing of Epstein’s criminal behaviour, his financial support, estimated to exceed £160 million, was foundational to Epstein’s empire.

The Impact of Their Fallout in 2007

Wexner’s severance of ties with Epstein in 2007 corresponded with a significant downturn in Epstein’s business income.

Financial Trust Company, Epstein’s primary firm at the time, earned over £230 million in fee income from 2000 to 2006. After Wexner withdrew his support, that number plummeted to less than £4 million in the following six years.

How Did Leon Black Contribute to Epstein’s Wealth?

When Wexner exited the scene, Leon Black entered. The co-founder of Apollo Global Management began working with Epstein around 2012, allegedly for estate and tax planning services. Over five years, Black paid Epstein approximately £135 million.

When Wexner exited the scene, Leon Black entered. The co-founder of Apollo Global Management began working with Epstein around 2012, allegedly for estate and tax planning services. Over five years, Black paid Epstein approximately £135 million.

The breakdown of these payments is quite telling.

Table: Leon Black’s Payments to Epstein via Southern Trust

| Year | Payment (USD) | Description |

| 2012 | $5.5 million | Initial retainer (unreported in annual filings) |

| 2013 | $50 million | Lump-sum fees for tax and estate services |

| 2014 | $70 million | “Ad hoc” payments for ongoing advice |

| 2015 | $30 million | Continued consultancy, plus £8 million charity donation |

| 2017 | $8 million | Final payment before ending ties |

Black has insisted that the services provided “delivered substantial value,” reportedly saving him between $1 billion and $2 billion. However, there were no formal contracts or recorded outcomes to support those claims.

Legal and Reputational Consequences for Black

Black stepped down as CEO of Apollo in 2021 following revelations about the scale of his payments.

He later settled a civil case with the U.S. Virgin Islands for $62.5 million due to his ties to Epstein. “Even if no crimes were committed,” I once said during a discussion on financial ethics, “the optics are terrible.”

Were Epstein’s Businesses Legitimate or Just a Front?

Epstein’s financial firms, including Financial Trust Company and Southern Trust Company, appeared to be fully licensed entities. However, they had virtually no visible staff, no marketing, and no competitive presence in the wealth management industry.

The firms did, however, generate revenue. Between 1999 and 2018, Epstein’s two known companies reported over $800 million in combined income, with at least $490 million attributed to client fees.

Despite that, analysts and legal authorities have questioned whether the firms served as legitimate financial institutions or operated primarily as cover for illicit activity.

What Was the Role of the U.S. Virgin Islands in Epstein’s Financial Empire?

The U.S. Virgin Islands offered tax advantages through their Economic Development Commission (EDC). Epstein moved there in the 1990s and registered his companies in the region to benefit from reduced taxation.

The U.S. Virgin Islands offered tax advantages through their Economic Development Commission (EDC). Epstein moved there in the 1990s and registered his companies in the region to benefit from reduced taxation.

The territory offered:

- 90% exemption on corporate income tax

- 100% exemption on gross receipts and excise taxes

- 100% exemption on local taxes for qualifying businesses

Breakdown of Epstein’s Tax Benefits

Table: Epstein’s Tax Avoidance Strategy

| Period | Entity | Tax Paid | Estimated Savings |

| 1999–2009 | Financial Trust Company | $41 million | $160 million |

| 2010–2018 | Southern Trust Company | Unknown | $140 million |

| Total | Both entities combined | $41 million | $300 million+ |

In exchange, Epstein was required to:

- Employ at least 10 full-time Virgin Islands residents

- Invest at least $100,000 in a local business

Court documents later revealed that Epstein met these requirements, though just barely. His compliance allowed him to operate under the EDC benefits until his death in 2019.

Did Epstein Work with Other Billionaires and Entities?

Although Wexner and Black were his major patrons, Epstein had a wider network of wealthy connections.

Some of them reportedly included:

- Elizabeth Johnson, Johnson & Johnson heiress

- Glenn Dubin, co-founder of Highbridge Capital Management

- Various unnamed individuals introduced to JPMorgan Chase

Table: Notable Financial Connections Beyond Wexner and Black

| Name | Nature of Involvement | Financial Link |

| Elizabeth Johnson | Client until her death in 2017 | Unknown sum |

| Glenn Dubin | Highbridge Capital received $15M introduction fee | $1.3 billion JPMorgan acquisition |

| Plan D Holdings | Epstein-owned, loaned $30.5M by Leon Black | Allegedly involved in art transactions |

“Much of Epstein’s network remains hidden,” I often remind myself. The secrecy and lack of documentation mean we may never fully know who else was financially entangled with him.

How Did Epstein’s Wealth Survive After His Death?

When Epstein died in 2019, his estate remained highly liquid. Within months, assets were being sold and settlements arranged. As of March 2023, the estate still retained over £100 million in value.

Key financial actions by the estate included:

- Paying out £160 million in victim settlements

- Settling with the U.S. Virgin Islands for £105 million

- Receiving a £90 million tax refund from the IRS

- Repaying £25 million in outstanding loans

Epstein’s properties, including his islands and Manhattan mansion, were all sold as part of the estate liquidation process. Yet, despite the payouts, substantial funds remain.

What Do Financial Records Reveal About Epstein’s Transactions?

One of the most revealing discoveries came from the U.S. Senate Finance Committee, which uncovered that Epstein’s companies had over 4,700 financial transactions across four major banks.

One of the most revealing discoveries came from the U.S. Senate Finance Committee, which uncovered that Epstein’s companies had over 4,700 financial transactions across four major banks.

These transactions, totalling more than $1.9 billion, were conducted through:

- JPMorgan Chase

- Deutsche Bank

- Bank of America

- Bank of New York Mellon

“The scale of the transactions was shocking,” Senator Ron Wyden wrote in a 2023 letter. “It suggests an international web of financial activity that still hasn’t been fully untangled.”

The Treasury Department’s files reportedly hold further documentation, yet much of it remains classified or sealed under ongoing investigations.

Conclusion

Jeffrey Epstein’s wealth came from a tightly knit circle of billionaires, aggressive tax avoidance, and opaque financial dealings.

While he branded himself a financial expert, court records and investigations show a man who operated in shadows, profiting from the trust and ignorance of those around him.

Whether he was a financial genius, a con artist, or something far worse, one fact remains: Epstein’s fortune, like his crimes, was built on secrecy.

FAQs

What was Jeffrey Epstein’s net worth at the time of his death?

He was worth approximately $578 million, according to court filings from his estate.

Did Epstein run a real hedge fund?

No. Although he claimed to manage investments for billionaires, there is no public evidence that he ran a traditional hedge fund.

How much did Les Wexner pay Epstein?

Estimates suggest Wexner paid Epstein more than $200 million over their relationship, not including property transfers.

Why was Epstein based in the U.S. Virgin Islands?

The region provided massive tax breaks that allowed him to legally save hundreds of millions of dollars.

Who else worked with Epstein financially?

Aside from Wexner and Black, he had dealings with Highbridge Capital, Elizabeth Johnson, and reportedly advised many unnamed ultra-wealthy individuals.

What were Epstein’s companies?

He ran Financial Trust Company and Southern Trust Company, both based in the U.S. Virgin Islands, as well as J. Epstein & Co.

What is the U.S. government still investigating about Epstein’s finances?

The Senate Finance Committee is examining nearly $2 billion in transactions to determine the origins and uses of Epstein’s money.