The Listed Places of Worship Grant Scheme (LPWGS) has long been a cornerstone of support for faith-based communities across the United Kingdom.

For 2025/26, the UK government has confirmed the scheme’s continuation, enabling religious organisations to reclaim VAT paid on eligible repairs and maintenance of listed places of worship.

With a total budget allocation of £23 million and several new updates introduced from April 2025, understanding the scope, eligibility, and application process has never been more important.

This guide explains how the Listed Places of Worship Grant Scheme works in 2025, what the recent changes mean, and how organisations can apply successfully to secure funding before the budget is exhausted.

What Is The Listed Places Of Worship Grant Scheme And Who Is It For?

The Listed Places of Worship Grant Scheme (LPWGS) is a UK Government initiative administered by the Department for Culture, Media and Sport (DCMS).

It enables listed places of worship to reclaim the Value Added Tax (VAT) paid on eligible repairs and maintenance works.

The scheme exists to preserve historic religious buildings that serve as active places of worship and vital cultural landmarks across the United Kingdom.

This financial support helps reduce the burden of maintenance costs faced by faith communities responsible for caring for heritage structures.

The scheme applies to listed buildings used for public worship by any denomination, including churches, chapels, mosques, synagogues, temples, and meeting houses.

To qualify, a building must:

- Be listed as a historic property of special architectural or cultural significance.

- Be used primarily and regularly for public worship.

- Be maintained by a faith organisation recognised in the UK.

By helping to recover VAT on essential repairs, the scheme ensures that religious buildings remain safe, structurally sound, and accessible to communities.

What Types Of Repairs And Works Are Eligible For Funding Under The Scheme?

The LPWGS covers a wide range of repair and maintenance works that contribute to the preservation and safety of listed worship buildings.

Only works considered “eligible” by the scheme qualify for VAT recovery, and they must be directly related to the repair or maintenance of the building fabric.

Examples of eligible repair works include:

- Roof, gutter, and drainage repairs

- Stonework, masonry, and brickwork restoration

- Conservation of stained glass and leaded windows

- Structural reinforcements for towers and walls

- Repairs to flooring, timber, and internal surfaces

- Electrical and lighting systems that ensure building safety

Ineligible works include:

- Routine cleaning or decorative maintenance

- Furniture, carpets, and non-fixed items

- New construction or extensions not related to repair

- Security systems, heating installations, or external landscaping

The minimum VAT amount eligible for claim is £1,000. However, applicants can submit one claim between £500 and £999 during any 12-month period.

This flexibility helps smaller congregations undertake urgent minor repairs without waiting for larger projects to accumulate.

How Much Funding Is Available For 2025/26 And What Are The New Limits?

The UK Government has confirmed that the Listed Places of Worship Grant Scheme will continue through to 31 March 2026.

The total allocated budget for the 2025/26 financial year is £23 million, covering both direct grant payments and the administrative costs of managing the scheme.

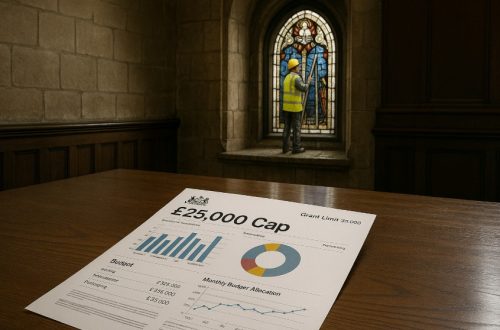

To maintain fair access, the government has introduced an annual cap of £25,000 per listed place of worship. This means that while organisations can make multiple claims throughout the year, their total grant awards cannot exceed £25,000.

As of 30 September 2025, the funding status is as follows:

| Funding Category | Amount (£) |

| Total Budget | 23,000,000 |

| Funding Used To Date | 8,628,286 |

| Value Of Grant Claims In Progress | 590,367 |

| Funding Remaining | 13,781,347 |

The scheme will remain open until 31 March 2026, or until the budget is fully used whichever comes first.

Applicants are therefore encouraged to apply early to ensure they receive funding before the allocation runs out.

How Does The VAT Refund Process Work For Listed Buildings?

The primary purpose of the LPW Grant Scheme is to refund VAT costs incurred on eligible repair works.

The refund process follows a structured approach to ensure transparency and accountability.

Step-by-step Refund Process

- The applicant completes eligible repair or maintenance work.

- Contractors issue VAT invoices for the work carried out.

- The applicant pays the invoices in full and keeps all proof of payment.

- The application form is completed, attaching all necessary documents.

- The claim is reviewed by the scheme’s administrators.

- Once approved, the applicant receives a direct refund equivalent to the VAT paid.

VAT refunds are processed only after payments have been made in full. Applicants should keep detailed records and ensure that invoices clearly display VAT breakdowns, supplier details, and itemised work descriptions.

The processing time typically takes around 30 working days, but it can vary depending on the volume of applications received.

What Are The Application Steps For The Listed Places Of Worship Grant Scheme 2025?

Applying for the scheme requires careful preparation and accuracy. Applicants must gather documentation that supports both the eligibility of the building and the authenticity of the expenses claimed.

Steps to apply:

- Check eligibility: Confirm the building’s listed status and ensure it is used for regular worship.

- Gather evidence: Collect invoices, photographs of works, proof of payment, and listing certificates.

- Complete the application form: Available through the official government website at listed-places-of-worship-grant.dcms.gov.uk.

- Submit the claim: Send the form and documents by post or email to the scheme administrators.

- Await assessment: Once processed, applicants will receive payment directly into their nominated bank account.

Claims that are incomplete, lack valid invoices, or include ineligible works may be delayed or declined. Applicants are therefore advised to double-check all documents before submission.

What Documents And Evidence Are Required When Submitting A Claim?

Documentation is essential to demonstrate compliance with the scheme’s requirements. Each application must include clear, verifiable evidence of the work carried out and the costs involved.

Mandatory Documents Include

- VAT invoices showing supplier information and details of the works

- Proof of payment (bank statement or transaction confirmation)

- Photographs of repairs before and after completion

- Confirmation of the building’s listed status

- Proof that the site is regularly used for public worship

Submitting complete documentation helps ensure faster processing and reduces the likelihood of queries or rejection. Applicants should retain copies of all materials submitted for their own records.

How Is The Funding Being Tracked And How Much Remains For 2025/26?

Overview Of The Annual Budget Allocation

For the financial year 2025/26, the Listed Places of Worship Grant Scheme has been allocated a total budget of £23 million by the Department for Culture, Media and Sport (DCMS).

This budget is used to reimburse eligible VAT costs and cover the administration of the scheme. The funding is available to listed places of worship across the UK until either the full amount is claimed or the scheme closes on 31 March 2026.

Real-Time Budget Tracking And Transparency

To ensure transparency and help applicants plan effectively, the budget usage is tracked and updated fortnightly on the official scheme website by EMB, the organisation responsible for administering the claims process. These updates give potential applicants a clear understanding of:

- How much of the total funding has already been used

- The current value of claims under review

- The remaining budget available for new applications

This system helps manage expectations and allows places of worship to assess the urgency of submitting their claims.

Current Funding Status As Of October 2025

Based on the most recent update, dated 30 September 2025, the funding status is as follows:

| Funding Category | Amount (£) |

| Total Budget (2025/26) | 23,000,000 |

| Funding Used To Date | 8,628,286 |

| Grant Claims In Progress | 590,367 |

| Funding Remaining | 13,781,347 |

With just under £14 million remaining, a significant portion of the budget is still available. However, as the scheme operates on a first-come, first-served basis, applicants are advised not to delay submissions, especially for larger claims that approach the £25,000 cap.

Importance Of Acting Early

Given the trend from previous years, the final quarter of the financial year often sees a sharp increase in applications as organisations finalise repair projects.

Applying during autumn or early winter may increase the chances of claim approval before the budget is exhausted. Late applications risk falling outside the available budget if funds are depleted before March 2026.

What Changes Were Introduced To The Scheme From 1 April 2025?

Background And Context

Following a surge in demand during the 2024/25 funding cycle, several changes were implemented from 1 April 2025 to improve scheme sustainability, widen access, and ensure equitable fund distribution.

As of October 2025, these changes have been in place for over six months, giving administrators and applicants clearer insight into how the updates are functioning in practice.

Introduction Of An Annual Cap Per Place Of Worship

One of the most significant changes introduced was the implementation of a £25,000 annual cap per listed place of worship. This means that no individual site can claim more than £25,000 in VAT reimbursements within the current financial year.

Key implications of the cap:

- Applicants can submit multiple claims, but the total grant payments cannot exceed £25,000

- Once the cap is reached, any additional VAT costs must be covered by the organisation or deferred to the next funding year (if applicable)

- The cap helps distribute funding more evenly, especially among smaller parishes or congregations with limited resources

This update has made it easier for more sites to benefit, as previously, a small number of high-value claims could consume a disproportionate share of the annual budget.

Budget Rollover From The 2024/25 Cycle

Due to an exceptional number of late-stage applications submitted before the 31 March 2025 deadline, the scheme carried forward a small portion of the 2025/26 budget to cover these claims.

A total of £469,000 from this year’s allocation was used to settle eligible claims that fell just before the previous year’s cutoff.

This rollover ensured that no eligible applicant from the 2024/25 cycle was excluded due to timing, but it also reduced the available starting budget for the current year slightly.

Revised Claim Guidelines And Q&A Resources

As part of the scheme’s update, the official guidance materials were overhauled and republished in April 2025. These include a new Q&A document aimed at clarifying common areas of confusion, such as:

- Minimum claim thresholds and when the £500–£999 exception applies

- Requirements for supporting evidence (e.g., photographs, payment confirmations)

- Claim timelines and what delays to expect

- Explanation of why certain works are deemed ineligible

Organisations applying after April 2025 are strongly encouraged to review the latest documentation to ensure compliance with the most up-to-date rules and reduce the likelihood of rejection or delayed processing.

Early Feedback From Applicants And Administrators

Since these changes were implemented, early feedback has been largely positive. Many smaller places of worship have reported that the £25,000 cap makes the scheme feel more accessible.

At the same time, administrators have noted a smoother application review process due to more consistent documentation and clearer applicant understanding.

However, there is still a risk of last-minute claim surges, particularly in the final quarter. This highlights the ongoing importance of early application planning and precise record-keeping.

How Does The Listed Places Of Worship Grant Scheme Compare To Other UK Heritage Funding Options?

While the LPW Grant Scheme focuses on VAT recovery, several other heritage and conservation funding programmes are available in the UK. Each serves a different purpose, from urgent repairs to long-term restoration or community engagement.

The table below outlines how the LPWGS compares to other major heritage funding options:

| Funding Scheme | Primary Focus | Type of Support | Eligibility |

| LPW Grant Scheme | VAT refunds on repairs to listed worship buildings | Reimbursement | Listed worship buildings used for public worship |

| ChurchCare Grants | Conservation and repair of church fabric | Direct funding | Churches and cathedrals in the UK |

| National Lottery Heritage Fund | Heritage restoration and community heritage projects | Project-based grants | Registered charities and community organisations |

| Historic England Repair Grants | Urgent repairs to Grade I and II* listed buildings | Targeted financial aid | Heritage sites at risk across England |

For some projects, combining support from multiple funding schemes can be advantageous, as long as there is no duplication of VAT claims for the same works. Applicants should consult each scheme’s specific rules before applying.

What Tips Can Help Applicants Maximise Their Claim Success?

To make the most of the Listed Places of Worship Grant Scheme, applicants should focus on planning, documentation, and timing. Success often depends on how well-prepared the application is and how accurately it reflects the project’s scope.

Helpful strategies include:

- Applying early in the financial year to avoid missing out once the budget is exhausted.

- Combining multiple smaller repair jobs into one claim to exceed the minimum VAT threshold.

- Keeping all receipts and supplier invoices neatly filed and labelled.

- Reviewing the official scheme guidance before starting the application process.

- Seeking advice from diocesan or faith-based property officers familiar with the scheme.

Proper organisation and understanding of eligibility rules can significantly reduce errors and ensure quicker approval.

How Long Does It Take To Receive Payment After Applying?

Processing times for LPWGS applications typically average around 30 working days, although complex claims or incomplete documentation may cause delays.

Once approved, payments are made directly to the applicant’s nominated account.

Applicants can track the progress of their submission by contacting the scheme administrators. If additional information or clarification is required, applicants will be notified promptly.

Ensuring that all forms and documents are correctly completed from the start helps to minimise any processing delays.

Conclusion

The Listed Places of Worship Grant Scheme 2025 offers vital financial support to maintain the UK’s historic religious buildings.

With a £25,000 annual cap and a fixed budget of £23 million, timely applications and accurate documentation are essential.

By understanding the scheme’s criteria, preparing claims carefully, and applying early, places of worship can benefit from valuable VAT refunds on eligible repairs.

This funding ensures that these important community landmarks remain safe, preserved, and accessible for future generations.

Frequently Asked Questions

Is the grant available for all religious denominations?

Yes, the scheme is open to all faith groups as long as the building is listed and actively used for public worship.

Can unlisted churches or places of worship apply for this grant?

No, only buildings officially listed as of special architectural or historic interest are eligible.

Can I submit multiple claims within a year?

Yes, multiple claims are allowed as long as the total amount claimed does not exceed £25,000 in the financial year.

What happens if my claim exceeds the £25,000 cap?

Only the first £25,000 in VAT costs per building per financial year will be reimbursed.

Can volunteer labour costs be claimed under this scheme?

No, the scheme only covers costs paid to external suppliers and contractors, not volunteer work.

What if my claim is rejected?

Rejected claims may be resubmitted after correcting the issues identified. Guidance is provided with the rejection notice.

Does the funding cover improvements or only repairs?

The scheme is strictly for repairs and conservation. Enhancements, new construction, or aesthetic upgrades are not covered.