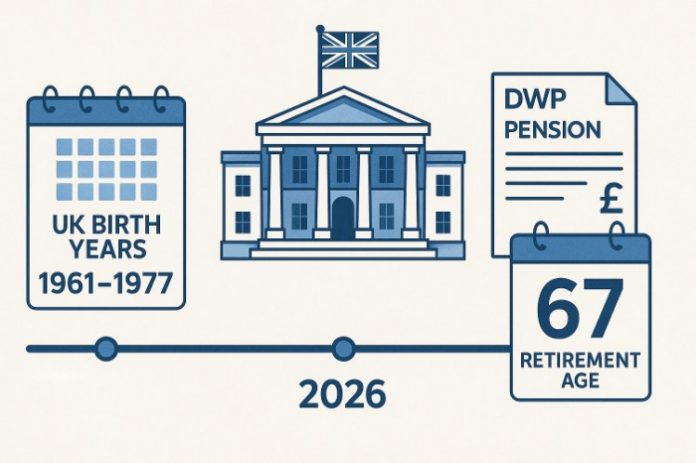

The UK State Pension age is undergoing another planned increase as part of long-term legislative reforms.

From 2026, individuals born in certain years will experience changes to when they can start claiming their State Pension.

These adjustments are part of the government’s broader efforts to respond to increasing life expectancy and maintain the sustainability of public pension provisions.

This guide provides a detailed overview of the 2026 State Pension age increase, the specific birth years impacted, the reasoning behind the change, and how individuals can prepare effectively.

What Is the Current State Pension Age in the UK?

The current State Pension age in the UK is 66 for both men and women. This equalisation was implemented between December 2018 and October 2020, bringing an end to the previously different pension ages for men and women.

The current State Pension age in the UK is 66 for both men and women. This equalisation was implemented between December 2018 and October 2020, bringing an end to the previously different pension ages for men and women.

The change was driven by broader legislative reforms aimed at maintaining pension system fairness and adapting to modern demographic trends.

The pension age is not static. Two key Acts shape the current and future pension age structure:

- Pensions Act 2007: Initially proposed a gradual rise in the State Pension age from 65 to 68 between 2024 and 2046. This was based on life expectancy and the need for fiscal sustainability.

- Pensions Act 2014: Accelerated the timeline, meaning the pension age will now rise from 66 to 67 starting in 2026, completing by 2028.

The State Pension age is also subject to review every five years to ensure it aligns with the latest data on life expectancy, public finances, and fairness across the population.

Who Will Be Affected by the State Pension Age Increase in 2026?

Birth Years Impacted by the 2026 Pension Age Increase

The upcoming rise in the State Pension age from 66 to 67 will primarily impact individuals born between 6 March 1961 and 5 April 1977.

This demographic was previously expected to retire at 66, but under the Pensions Act 2014, the timeline has been accelerated.

If your date of birth falls within this range, your eligibility age for the State Pension will now shift to 67, beginning with changes implemented from April 2026 to April 2028.

Phased Introduction Based on Date of Birth

The implementation of the pension age change is not immediate for everyone. Instead, it will be introduced gradually over a two-year period, to avoid a sudden cut-off that would unfairly affect individuals born close to the threshold.

Here’s how the phasing will work:

- Those born earlier in the date range (March 1961–early 1963) will see their pension age rise to 67 earlier within the phase

- Those born closer to April 1977 will reach 67 slightly later, closer to 2028

This staggered approach aims to minimise disruption and allow people time to plan accordingly.

Government Notification and DWP Letters

To ensure clarity, the Department for Work and Pensions (DWP) will send letters to all individuals affected by the change. These official notices will:

- Confirm the new pension age

- Provide an estimated date when you will reach eligibility

- Outline resources for further planning and questions

It’s crucial for individuals born in this period to keep their contact details updated with DWP so they receive timely information.

Individuals Not Affected by the 2026 Change

Not everyone is impacted by the 2026 rise. Those born before 6 March 1961 will still be able to claim the State Pension at age 66, according to existing legislation.

Individuals born after 5 April 1977 are not immediately impacted by the 2026 change but could be affected by future reviews and reforms, especially the proposed rise to age 68, which may come into effect in the 2030s or 2040s.

Why Is the UK Government Raising the Pension Age Again?

Increasing Life Expectancy and Longevity Trends

One of the most significant drivers of the pension age increase is rising life expectancy. Over the past few decades, improvements in healthcare, nutrition, and living standards have led to people living longer, healthier lives.

As a result, more people are spending a larger portion of their lives in retirement. This puts a growing financial strain on the State Pension system, which was originally designed in an era when life expectancy was much lower.

Balancing Public Finances and Sustainability

The UK government faces the challenge of ensuring the long-term affordability of the State Pension.

With more people drawing pensions and fewer working-age individuals contributing through taxes, the system risks becoming financially unsustainable.

Raising the pension age allows the government to:

- Reduce the number of years pensions are paid

- Delay payouts for upcoming retirees

- Encourage longer participation in the workforce

These measures are part of broader public finance strategies to manage the ageing population without increasing the burden on future generations.

Legal Framework Supporting the Change

The Pensions Act 2014 provides the legal foundation for increasing the State Pension age. This legislation revised the previous timetable and mandated regular reviews to ensure that pension policy remains aligned with demographic realities.

The Act also introduced the principle that people should be able to spend approximately one-third of their adult life receiving a State Pension, with the remainder spent contributing through work or National Insurance.

This guiding principle has helped shape not only the 2026 change but also future proposals, such as the possible rise to 68.

The Role of Regular Pension Age Reviews

A key part of the UK’s approach to pension policy is the five-yearly State Pension age review process. These reviews evaluate several core areas:

- Life expectancy forecasts across the UK

- Differences in health outcomes by region and socioeconomic status

- Labour market participation trends

- Public expenditure modelling

The most recent review is expected to determine whether the increase to 68 should be brought forward, potentially affecting individuals born after 1970. Any such proposal, however, must still pass through Parliament before becoming law.

Impact on Individuals and Workforce Dynamics

Raising the pension age inevitably affects individuals’ life plans, particularly those nearing retirement. It can also influence:

- Career decisions, especially for those in physically demanding jobs

- Retirement savings strategies

- Dependence on personal or workplace pensions during the interim years

The government has indicated that maintaining a balance between fairness, economic viability, and individual impact remains a priority in these policy decisions.

How Can You Check Your State Pension Age Online?

Knowing your exact State Pension age is important for financial planning, especially with the upcoming 2026 changes. The UK government provides a simple tool on the GOV.UK website to help individuals find this information.

Using the State Pension age checker, individuals can confirm:

- The date they will reach State Pension age

- Their qualifying age for Pension Credit

- When they can receive free bus travel, which varies by location

This tool is accessible to everyone, regardless of age. It takes only a few minutes to use and is considered an essential first step for retirement planning.

In addition, the State Pension forecast service provides more detailed insight into:

- How much pension you may receive weekly and annually

- Your National Insurance contribution record

- Any gaps in your NI history

- Options for voluntary contributions to increase your pension

Logging into the HMRC personal tax account or using the HMRC mobile app allows individuals to securely access this data.

What’s the Timeline for Future Pension Age Rises Beyond 2026?

After the 2026–2028 adjustment that increases the State Pension age from 66 to 67, the next scheduled change is to raise the age to 68. This increase is planned under the Pensions Act 2007 for implementation between 2044 and 2046.

However, recent discussions suggest that the timeline might be accelerated. The Conservative government previously proposed:

- A review of the State Pension age by the mid-2020s

- Potential implementation of the age 68 increase by the late 2030s

Any change must first undergo a thorough government review and then pass through Parliament before becoming law.

The State Pension age reviews will continue every five years and will consider:

- Trends in longevity

- Employment patterns

- The proportion of life expected to be spent in retirement

Decisions will be made with a focus on fairness and long-term economic sustainability.

How Can You Boost Your State Pension Through Voluntary Contributions?

If you have gaps in your National Insurance (NI) record, you might not qualify for the full new State Pension, which currently requires 35 qualifying years of NI contributions. Individuals need at least 10 years to receive any State Pension at all.

To help address this, the UK government has allowed individuals to make voluntary NI contributions to cover missed years. This can significantly increase pension entitlement in retirement.

Eligibility includes:

- Men born on or after 6 April 1951

- Women born on or after 6 April 1953

Normally, you can only backdate contributions for the past six tax years. However, a special extension has been granted until 5 April 2025, allowing eligible people to cover years between 2006 and 2018.

Table: Key Contribution Periods

| Period | Contribution Eligibility | Deadline |

| April 2006 – April 2018 | Yes (under transitional rules) | 5 April 2025 |

| Last six tax years (rolling) | Yes | 6 years prior to today |

| Beyond 6 years (non-transition) | No | Not eligible |

Using your HMRC online account, you can view your NI record and make payments digitally. The process includes a short survey to determine your eligibility, followed by secure payment options.

Only pay for the years you need. Overpaying does not result in additional pension benefits and excess payments are generally non-refundable unless an error occurred.

What Should You Know About National Insurance Gaps and Deadlines?

NI gaps can occur for many legitimate reasons. Understanding the cause and impact is essential before deciding whether to make voluntary payments. Common scenarios include:

- Taking time off work to raise children

- Periods of illness or disability

- Unemployment

- Working or living abroad

Some individuals qualify for NI credits, which count toward the State Pension without requiring a financial contribution. These credits are available for carers, jobseekers, and others with valid reasons for missing contributions.

Key steps to take include:

- Checking your NI record through the HMRC online portal

- Reviewing which years have missing or insufficient contributions

- Determining whether credits are available before deciding to pay

The new digital system, introduced by HMRC in 2023, has already enabled over 10,000 individuals to make contributions totalling £12.5 million. The system provides clear instructions, eligibility checks, and payment confirmation, making the process simpler than before.

What Does This Mean for Retirement Planning in the UK?

For those born between 1961 and 1977, the change in State Pension age impacts more than just the date benefits begin. It requires a shift in retirement strategy and long-term financial planning.

Points to consider:

- Delayed access to State Pension means a potential income gap between retirement and pension eligibility

- Workplace pensions and personal savings will become more important for bridging this gap

- It’s essential to assess your retirement date, income needs, and health status when making pension-related decisions

People nearing retirement should take the time to:

- Use the GOV.UK tools to check forecasts

- Review NI records for completeness

- Evaluate the cost-benefit of making voluntary contributions

- Speak with a financial adviser if they’re unsure about top-ups or investment strategies

Planning early can lead to a more stable and informed transition into retirement.

Conclusion

The upcoming increase in the UK State Pension age from 66 to 67, starting in 2026, will significantly affect individuals born between 1961 and 1977.

Understanding how this change impacts your retirement planning is essential. By checking your pension age, reviewing your National Insurance record, and considering voluntary contributions where necessary, you can better prepare for the future.

Staying informed and taking timely action ensures financial stability and helps make the transition into retirement smoother and more predictable.

Frequently Asked Questions

What happens if I don’t have 35 qualifying years of National Insurance?

You’ll receive a reduced State Pension based on the number of qualifying years you do have. You can improve this by making voluntary contributions or applying for NI credits.

Can I receive State Pension while living abroad?

Yes, you can still receive the State Pension if you live abroad, but it may not increase annually depending on the country of residence.

How do I apply to make voluntary NI contributions?

Use your personal tax account or the HMRC app to check your record. If eligible, you can make payments online or contact HMRC for support.

Are the changes in 2026 already law?

Yes, the 2026 increase to age 67 is part of the Pensions Act 2014 and is already legislated.

What’s the difference between workplace pension and State Pension?

The State Pension is provided by the government, while workplace pensions are arranged by employers. You may have access to your workplace pension before reaching State Pension age.

How much is the full new State Pension?

As of 2025, the full new State Pension is approximately £221.20 per week, but the amount may vary based on your record.

What if I paid too much into National Insurance?

If you’ve made more contributions than necessary, there’s typically no refund unless an error was made. It’s best to check your forecast before paying.