As the new year approaches, parents and guardians across the UK are seeking clarity on what changes, if any, are coming to Child Benefit in January 2026.

With various online discussions, speculative reports, and some genuine updates, it’s important to separate facts from fiction.

While no immediate changes are scheduled for January, April 2026 will mark the beginning of significant adjustments to Child Benefit rates and related welfare policies.

In this article, we break down the confirmed facts, dismiss the common rumours, and provide clear, updated information on how Child Benefit will evolve in 2026.

What Are The Latest Updates On Child Benefit From January 2026?

As of January 2026, there are no changes to the current Child Benefit system. The rates that were put in place for the 2025–26 tax year will continue until the end of the financial year in April.

As of January 2026, there are no changes to the current Child Benefit system. The rates that were put in place for the 2025–26 tax year will continue until the end of the financial year in April.

This is consistent with the UK government’s usual policy of implementing changes to benefits and tax credits in April, aligning with the new tax year.

The speculation about a new Child Benefit taking effect in January likely arises from general confusion or early announcements. However, there are no official updates or scheduled changes specifically beginning in January.

Families will continue to receive the same benefit amounts they were entitled to throughout the 2025–26 tax year.

That said, parents should still monitor official communications from HMRC, especially if they experience a change in circumstances, such as the birth of another child, a change in address, or a shift in income.

What Will The New Child Benefit Rates Be From April 2026?

The confirmed new Child Benefit rates will apply from April 2026, marking the start of the 2026–27 tax year.

The UK government adjusts these rates annually based on inflation and broader economic conditions to support families with the rising cost of living.

Here is a breakdown of the upcoming rate changes compared with the current rates.

Weekly Child Benefit Rates

| Child Category | Weekly Rate (From April 2026) | Weekly Rate (2025–26) |

| Eldest or Only Child | £27.05 | £26.05 |

| Each Additional Child | £17.90 | £17.25 |

The increases represent a £1.00 weekly rise for the first child and £0.65 for each additional child. These changes, although not large individually, will add up over time, especially for larger families.

Monthly Equivalent Based on Four-Week Payment Cycles

| Number of Children | Monthly Payment (2026–27) | Monthly Payment (2025–26) |

| One Child | £108.20 | £104.20 |

| Two Children | £179.80 | £172.20 |

| Three Children | £251.50 | £240.45 |

Most Child Benefit payments are made every four weeks, so the monthly impact is noticeable.

For example, a family with three children will receive an additional £11.05 per month compared to the previous year.

These new rates will be automatically applied by HMRC, and no additional action is required by existing claimants unless their circumstances have changed.

Is The Guardian’s Allowance Also Changing In 2026?

Yes, the Guardian’s Allowance is set to increase in line with the April 2026 Child Benefit uprating. This benefit is a supplementary payment for individuals responsible for raising a child whose parents have died.

Yes, the Guardian’s Allowance is set to increase in line with the April 2026 Child Benefit uprating. This benefit is a supplementary payment for individuals responsible for raising a child whose parents have died.

The updated weekly rate is as follows:

- Previous rate (2025–26): £22.10 per week

- New rate (from April 2026): £22.95 per week

While the increase is relatively modest at £0.85 per week, it aligns with the government’s broader strategy of increasing family support through incremental adjustments.

Eligibility for Guardian’s Allowance remains unchanged. It is still available to people who:

- Are looking after a child whose parents have died

- Receive Child Benefit for that child

- Are not the child’s parent themselves

- Meet certain residency conditions

This allowance is paid in addition to Child Benefit and is not affected by the High-Income Child Benefit Charge.

Are There Any Child Benefit Changes Happening In January 2026?

No official Child Benefit changes will be implemented in January 2026. The 2025–26 tax year rates will still be in effect until the end of March.

The next confirmed adjustments will begin in April 2026, not earlier.

The confusion around January changes may stem from:

- Early reporting of April rate updates

- Speculation on benefit reforms

- Misunderstanding of the tax year structure

In summary, parents should expect their January 2026 payments to follow the same rate they’ve been receiving throughout the financial year.

What Other Benefits And Policy Changes Affect Families In 2026?

Although Child Benefit itself is not changing in January, significant policy developments are coming into effect in April 2026 that will impact family welfare more broadly.

Although Child Benefit itself is not changing in January, significant policy developments are coming into effect in April 2026 that will impact family welfare more broadly.

The most notable among them is the change to Universal Credit rules.

Scrapping Of The Two-Child Limit In Universal Credit

One of the most important policy shifts for families is the removal of the two-child limit on the child element of Universal Credit.

This rule, introduced in 2017, limited additional support for families claiming Universal Credit or Tax Credits if they had more than two children, with a few exceptions.

From April 2026:

- Families will be able to claim the child element for every child in the household

- There will be no restriction on the number of children eligible for Universal Credit support

- This change will apply to new and existing claims

This reform is expected to support large families who have, up until now, received less assistance despite having greater financial needs.

Impact On Overall Family Income

The removal of the two-child cap is likely to have a meaningful impact on household finances, especially when combined with the updated Child Benefit rates.

Although Child Benefit remains a separate entitlement from Universal Credit, many families receive both.

Combined with increases in other support such as Housing Benefit or Cost of Living Payments, 2026 could bring noticeable financial relief for qualifying families.

Will The High-Income Child Benefit Charge Still Apply In 2026?

Yes, the High-Income Child Benefit Charge (HICBC) remains in place for the 2026–27 tax year. This charge requires higher-earning households to repay some or all of the Child Benefit received.

Currently, the thresholds are as follows:

- If one parent’s adjusted net income exceeds £60,000, they must repay part of the Child Benefit

- If the income exceeds £80,000, the full amount must be repaid

There are no confirmed changes to these thresholds for 2026, although various groups have campaigned for them to be updated to reflect inflation and rising wages. As of now, the policy remains:

- Calculated on a sliding scale (1% of Child Benefit repaid for every £100 over £60,000)

- Paid via the self-assessment tax process

- Applied regardless of which parent claims the benefit

Households affected by HICBC may choose to opt out of receiving Child Benefit payments while still accruing National Insurance credits, particularly if one parent is not working and wishes to protect their State Pension entitlement.

How Can Parents Claim Or Update Their Child Benefit In 2026?

Claiming Child Benefit remains a straightforward process, and most new parents will already be aware of the required steps.

However, in 2026, digital services and application processes are expected to remain largely the same, with improvements in processing speed and customer service via HMRC’s online platforms.

How To Make A Claim?

Parents can claim Child Benefit:

- Online via HMRC’s portal using a Government Gateway account

- By post using the CH2 form for new claims

- By phone for changes or urgent updates

Key Steps After A New Birth

For parents of newborns in 2026, the process remains:

- Register the birth with your local council

- Apply for Child Benefit within three months to avoid losing backdated payments

- Provide the child’s birth certificate and your National Insurance number

Updating Existing Claims

Parents should update HMRC promptly if:

- A child turns 16 or leaves full-time education

- Custody arrangements change

- You move to a new address

- Your income rises above the HICBC threshold

The ability to manage claims digitally has improved, allowing families to access benefit history, view upcoming payments, and update details quickly.

What Are The Common Rumours About Child Benefit In 2026?

Despite clear government statements, several persistent rumours have circulated in the media and on social platforms regarding supposed Child Benefit changes in 2026.

Despite clear government statements, several persistent rumours have circulated in the media and on social platforms regarding supposed Child Benefit changes in 2026.

It’s important to address and correct these to avoid misinformation.

Common Misconceptions

- Rumour: Child Benefit will be scrapped in January 2026

This is not true. The government has confirmed ongoing support through increased payments from April 2026. - Rumour: Child Benefit will be rolled into Universal Credit

There are no plans to merge Child Benefit with Universal Credit. They remain distinct benefits with different eligibility criteria. - Rumour: Only working families will be eligible from 2026

Child Benefit is not means-tested. Eligibility is based on responsibility for the child, not on employment status. - Rumour: There will be a delay in payments during early 2026

No delays have been announced. Payments will continue on the regular four-week schedule unless affected by bank holidays.

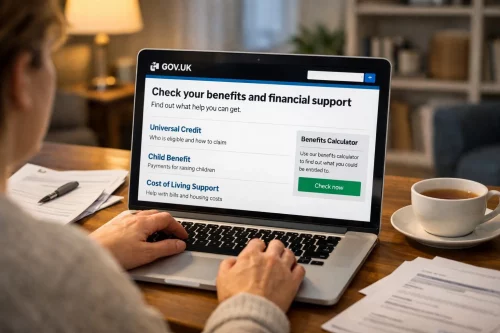

Reliable Sources Of Information

To avoid confusion and ensure you have the latest and most accurate information, always refer to:

- GOV.UK for official guidance

- HMRC’s updates and announcements

- Trusted news outlets like BBC News, The Guardian, or Financial Times

- Professional advisors or citizen support organisations

Conclusion

While the term “new child benefit January 2026” may imply changes at the start of the year, all official adjustments are scheduled for April 2026, coinciding with the new tax year.

These include increases in Child Benefit rates, adjustments to Guardian’s Allowance, and significant changes to Universal Credit policy that benefit larger families.

Parents are encouraged to stay informed through official channels and avoid acting on unverified rumours.

The confirmed updates for 2026 demonstrate continued government support for families navigating the cost of living in the UK.

FAQs

Will Child Benefit increase again after April 2026?

It’s possible. Child Benefit is usually reviewed annually and adjusted in April based on inflation and government budget priorities.

Can I claim Child Benefit if I’m not working?

Yes, employment status does not affect your eligibility. As long as you’re responsible for a child under 16 (or under 20 if in approved education/training), you can claim.

How long does it take to process a new Child Benefit claim?

Typically, claims are processed within 3 to 12 weeks. It’s advisable to apply as soon as possible after your child’s birth or arrival.

Will the income threshold for HICBC change in 2026?

There are no announced changes for the 2026–27 tax year. The thresholds remain at £60,000 for partial repayment and £80,000 for full repayment.

Is Child Benefit means-tested?

No, it is not means-tested. However, high-income earners may need to repay some or all of it through the HICBC.

Can I receive Child Benefit and Universal Credit at the same time?

Yes. They are separate benefits. Receiving one does not disqualify you from the other.

Do I need to reapply for Child Benefit every year?

No, once approved, Child Benefit continues automatically unless your circumstances change (e.g. child leaves education, custody changes).